A-shares got off to a good start in 2021. On January 4th, the market went up unilaterally all day, and the Shanghai Composite Index stood at 3,500 points. The turnover of the two cities once again exceeded one trillion yuan after nearly two months. However, the net outflow of northbound funds on that day was 542 million yuan.

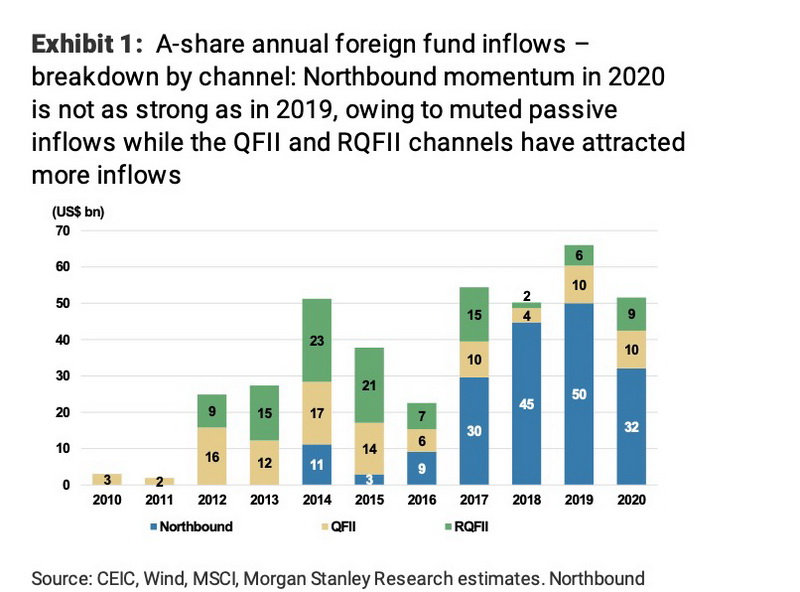

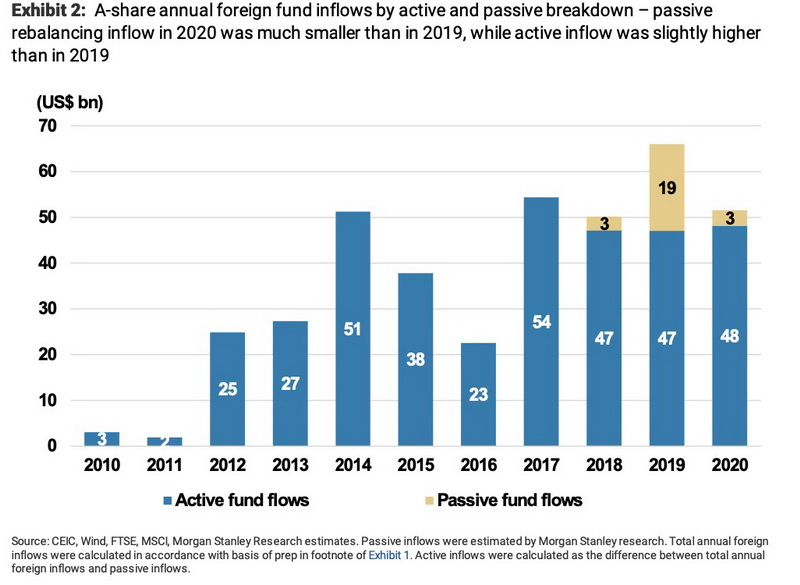

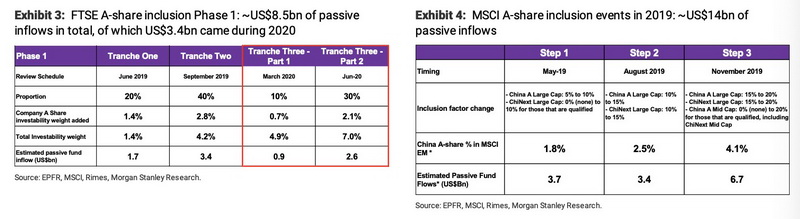

Looking back on 2020, the total inflow of northbound funds was 208.932 billion yuan. According to Morgan Stanley’s latest calculation, if the inflow of foreign capital through QFII/RQFII channels is added, the annual net inflow of foreign capital into A shares will be as high as 52 billion US dollars (about 338 billion yuan at the exchange rate of 65). It is worth mentioning that in 2020, the passive capital inflow is only $3.4 billion, and the active capital inflow is $48 billion, which is becoming more and more important. Therefore, many institutions predict that in the context of the improvement of global risk sentiment in 2021, even if MSCI suspends the expansion and inclusion of A shares (passive capital reduction), the annual capital inflow will still exceed 2020. Essence Securities predicts that the inflow of northbound funds alone is expected to reach 200 billion to 280 billion yuan in 2021; Guosheng Securities predicts that the net inflow of northbound funds will exceed 300 billion yuan in 2021, exceeding 2020.

Gao Ting, head of China research at Nomura Oriental International, told China Business News that 2021 is expected to be a big year for foreign capital to flow into A-shares. Although the overall valuation of A-shares is above the average of three or five years, foreign capital will bring additional valuation premium. As far as the theme is concerned, Morgan Stanley believes that international funds are particularly optimistic about the opportunities of the following themes in 2021 — — Consumption upgrading, high-end manufacturing (robotics, automation, etc.), new infrastructure (5G, Internet of Things, electric vehicle supply chain, etc.), national defense and aerospace, medical care/medicine/biotechnology, technology localization (semiconductor and hardware, software and application development).

QFII/RQFII channels catch up with Shanghai-Shenzhen-Hong Kong Stock Connect.

In 2020, a total of 208.932 billion yuan of northbound capital flowed into A-shares, which was significantly less than 352.889 billion yuan in 2019 and even less than 291.5 billion yuan in 2018, which was also related to the decline of global risk sentiment under the epidemic. However, the positive trend is that the proportion of active capital inflows is increasing.

Wang Ying, equity strategist at Morgan Stanley in China, told reporters that 2019 was a big year for passive capital inflows. Of the total foreign capital inflow of $66 billion in 2019, $19 billion (accounting for 29%) was contributed by the rebalancing events of five major indexes (two from FTSE Russell and three from MSCI), while the active capital inflow was $47 billion. In contrast, the passive capital inflow in 2020 is only $3.4 billion, which was triggered by FTSE Russell’s inclusion in the final stage of A-shares, while the active capital inflow is $48 billion. It can be seen that the importance of active funds is prominent.

At the same time, 2020 is also a year in which the importance of QFII/RQFII channels rises rapidly. Wang Ying said that the capital inflow through this channel is narrowing the gap with the northbound capital inflow through Shanghai-Shenzhen-Hong Kong Stock Connect. The reform measures of QFII/RQFII implemented in 2020 have significantly improved the accessibility of this channel, the accessibility of derivative tools and the convenience of capital return. Therefore, Morgan Stanley also predicts that the capital flowing into A shares through QFII/RQFII will account for 38% of the total foreign capital inflow in 2020, higher than 11% in 2018 and 24% in 2019.

"We expect QFII/RQFII channels to contribute more A-share capital inflows in the future. Investors should pay more attention to understanding the dynamics of foreign investment. " Wang Ying said. In the early years, due to the convenience of opening an account with Shanghai-Shenzhen-Hong Kong Stock Connect, many foreign investors began to use this channel to lay out A shares. However, with the continuous reform of QFII mechanism, especially the convenience of fund redemption, most foreign investors have indicated that they will use these two channels simultaneously as needed. Compared with Shanghai-Shenzhen-Hong Kong Stock Connect, foreign capital can participate in innovation through QFII/RQFII, and the range of A shares can be wider (Shanghai-Shenzhen-Hong Kong Stock Connect only covers about 1,500 A shares).

2021 is expected to become a year of foreign capital inflow.

It is precisely because of the strong momentum of active funds that international institutions judge that even in 2021, when passive funds may be weak, the momentum of foreign capital flowing into A shares will remain strong.

However, according to what MSCI said in an interview with the First Financial Reporter, if the reform is accelerated, the process of MSCI’s inclusion may also be accelerated, and passive funds may be increased again in 2021. These related reform measures include: the CSRC approved the listing of MSCI A-share index futures on the Hong Kong Stock Exchange, improved the trading holiday arrangement of Land Stock Connect, and solved the problem of short fund settlement cycle of A-shares. But for now, the probability is low.

The reason why institutions are still optimistic about the momentum of active capital inflow in 2021 is because of the improvement of global risk sentiment, the bright performance of A shares and unique theme opportunities.

"In 2020, A shares will become the best performing stock market in the world for the second year in a row — — The Shanghai and Shenzhen 300 Index achieved a price return rate of 35.5% (denominated in US dollars) in 2020, ahead of other major stock indexes in the world, and the performance of the Shanghai and Shenzhen 300 Index also surpassed other stock indexes in 2019. " Wang Ying said. Morgan Stanley maintains the view of over-allocation of A shares in 2021, and the target of the Shanghai and Shenzhen 300 Index at the end of 2021 is 5570 points, which means 6.9% upside.

Global risk appetite is particularly critical, which can be seen from the northward capital change in 2020. Gao Ting told reporters that 2020 is a small year of foreign capital inflow, and the net inflow is only about half that of last year. The premise of foreign capital flowing to emerging markets is generally the improvement of risk appetite, so it is necessary to find markets with higher investment returns. However, in 2020, the epidemic continued to disturb market sentiment, and the overall global risk appetite was low. "For example, in the second quarter of 2020, due to the release of water by global central banks, northbound funds suddenly poured into A shares, but before the third quarter, they flowed out due to uncertainties such as the US election. By November, the election results were basically clear and the vaccines were favorable, and northbound funds returned to A shares again."

At present, the basic judgment that global liquidity is heavy and vaccines promote economic recovery remains unchanged. Gao Ting believes that in the first quarter of 2021, the recovery will still be the macro background of the global capital market. It is suggested that investors tactically increase the allocation of optional consumption and cyclical stocks in the first quarter, especially considering the opportunities of automobiles, household appliances, home and media in optional consumption, and the promotion of some cyclical sectors brought about by the global recovery and rising inflation expectations. It is recommended to pay attention to the performance of oil and gas, copper and aluminum and small chemical industry leaders; As far as the whole year is concerned, the growth blue chip will still outperform, which is also related to the preference of foreign capital for the market leader. However, with the increasing familiarity of foreign capital with A shares, it will no longer focus on the traditional leader in the past.

Foreign capital favors these investment themes.

What themes do foreign investors favor? In fact, since 2020, foreign capital has bought A-share assets through QFII channel, and the list of industries and awkward stocks in its layout is often sought after by the market.

Of course, the disclosure data of QFII funds is lagging behind. According to the data, by the third quarter of 2020, Bank of Ningbo, China Pacific Insurance, Changjiang Electric Power and Bank of Beijing were the stocks whose market value exceeded 10 billion yuan. Midea Group, Hengrui Pharma, Gree Electric, CONCH and other core assets called "Super White Horse" by the market have also become one of QFII’s heavyweight targets. In 2020, there are also many leading stocks such as Gree Electric, Midea Group, Oriental Fortune, CONCH and Changjiang Electric Power in the list of buying and selling stocks with active capital in the north.

The new theme of 2021 is also receiving high attention. Miao Zimei, director of Asia stock investment of Fidelity International, told the First Financial Reporter that the Central Economic Conference set the policy of "no sharp turn" in 2021, kept the macro leverage ratio basically stable, and clarified eight key tasks in 2021, highlighting science and technology, industrial autonomy, expanding domestic demand, reform and opening up, seed farmland, housing, carbon neutrality and other major areas, strengthening anti-monopoly and preventing disorderly expansion of capital. "Therefore, we believe that funds will flow out of real estate and large Internet companies and flow into other key development areas."

"For 2021, we are particularly optimistic about the following five themes," Miao Zimei said, including the new energy industry (new energy vehicle industry chain, renewable energy, ESG-conscious enterprises), and the valuation of the whole vehicle sector is at a fairly high level, so we are more optimistic about the equipment in the middle reaches and related companies such as raw materials in the upper reaches; Commodities (precious metals, industrial products, agriculture), under the background of COVID-19 vaccine landing, with the deepening of people’s economic activities, the growth rate of consumer demand will continue to improve, and the supply end may tighten, which will make some commodities get a risk premium, optimistic about non-ferrous metals, agricultural products, ferrous metals, etc. Optional consumption (young consumers, green consumption, etc.), before 2017, consumption was mainly contributed by the post-1970 s, but its growth has slowed down marginally, and the growth rate of the post-1990 s is very strong; Health care (vaccine-related companies, innovative drugs, etc.) is more optimistic about the innovative industrial chain after the disturbance of quantity procurement, and the core investment direction is mainly in CXO, innovative drugs, innovative equipment and vaccine track; Network security, although the revenue growth rate of listed companies in this sector in the third quarter of 2020 was lower than the previous market expectation, and the overall industry demand recovered or slowed down under the epidemic, in the long run, the increase in the penetration rate of information security construction will still promote the industry to maintain a high prosperity.