● Parents of students should not pay more than 3 months or 60 class hours when paying training fees; Non-discipline training should pay no more than 5,000 yuan at a time to avoid the dispute of refund and the risk of "running away with money". At the same time, we should be wary of inducing over-time and over-limit charges by means of "recharge and gift"

● The reporter randomly selected 10 non-discipline training institutions for investigation and inquiry, and found that almost all of them have problems of excessive and overtime fees such as large class packages, which involve children’s programming, physical fitness, swimming, tennis, street dance, skiing, equestrian, fencing and dancing. Some class packages are "big" to 200 class hours. According to the staff, 48 class hours are around 10,000 yuan, and 20,000 yuan for 200 class hours can be won.

● It is necessary to clarify the regulatory responsibilities of relevant subjects, establish an institutional mechanism of multi-sectoral linkage and collaborative law enforcement led by the education department, and pay special attention to the role of market supervision departments and financial management departments; Actively promote the collation and revision of relevant laws and regulations, local regulations and normative documents, form a necessary list of powers and responsibilities, and provide a clear legal basis for relevant management departments to carry out supervision according to law.

□ Our reporter Zhao Li

□ Intern of this newspaper Hu Miao

"gone again?" Beijing parent Zhao Pei repeatedly confirmed to friends around him.

At the beginning of March, the art training institution that had previously enrolled children suddenly closed classes due to the problem of capital turnover, and she realized that her unpaid class fee was still more than 10,000 yuan — — This is the third time that Zhao Pei has encountered this situation in the past three years, with a total loss of about 30,000 yuan.

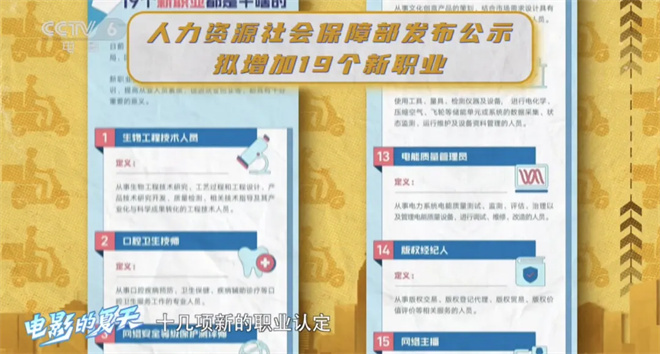

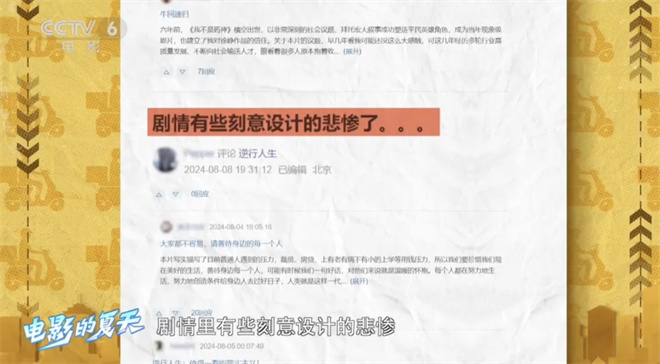

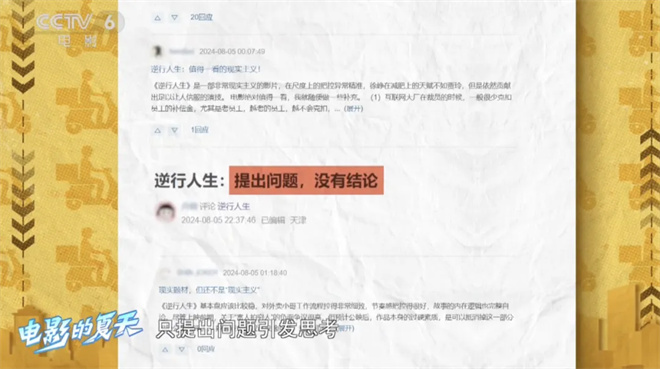

Recently, a number of well-known non-disciplinary training institutions have been suspected of exploding mines, which has aroused widespread concern, including the institution that Zhao Pei reported to children. On March 13th, the Ministry of Education and China Consumers Association issued a reminder for off-campus training, reminding parents not to pay more than 3 months or 60 class hours when paying training fees. Non-discipline training should pay no more than 5,000 yuan at a time to avoid the dispute of refund and the risk of "running away with money". At the same time, we should be wary of inducing over-time and over-limit charges by means of "recharge and gift".

However, according to a recent survey by the reporter of Rule of Law Daily, in the non-discipline training market, high-priced big course packages are still sold, and even some training institutions subcontract among various "bosses" when there are still a large number of parents who have not cancelled the course fees, which brings many potential risks to consumers.

Buy a big class bag to lower the unit price

Frequent encounters with institutions running away

In July 2021, the Central Office and the State Council issued the Opinions on Further Reducing Students’ Homework Burden and Off-campus Training Burden in Compulsory Education. After more than a year’s efforts, the discipline training governance has made phased progress. However, it is worth noting that while the off-campus training institutions of disciplines have been greatly reduced, the problems existing in non-discipline training have begun to stand out.

On March 2, Beijing Orange Tree Culture Communication Co., Ltd. (hereinafter referred to as Orange Tree), a well-known art education institution, announced that it would suspend the operation of all campuses for 7 to 10 days, which caused network concern. According to informed sources, the 17 campuses of the institution in Beijing may involve 90,000 students and more than 700 teachers.

Some media surveys have found that big class packages are the consistent sales strategy of orange trees. In an activist group of nearly 400 people, parents spontaneously collected statistics on the fees paid, among which the figure of large class bags frequently appeared. Because the agency publicized the actual payment of more than 10,000 yuan, they were given class hours worth 10,000 yuan, which attracted many parents to buy large class bags. Many parents paid more than 20,000 yuan at one time, and some parents actually paid 42,000 yuan.

In the non-discipline training industry, big course packages are nothing new. Li Zhao (pseudonym), who lives in Xicheng District, Beijing, once signed up for her daughter’s swimming training class in Caoqiao, Fengtai District. The courses were packaged and sold, with 30 small classes and 120 large classes.

"When I consulted, the marketing staff always recommended the big class package. Because of the huge difference in the price of a single class, most of the parents I know have purchased large class packages. " Li Zhao said.

However, parents who originally wanted to "buy big class bags and lower the unit price of each class" frequently encountered institutional running. Li Zhao told reporters that the off-campus training courses for piano, dance, speech and other non-discipline classes that she and several relatives’ children reported had all encountered the situation of "running away". "The extracurricular classes for four children in our whole extended family were met because of ‘ Run ’ At least 100,000 yuan was lost. "

"When the child was eight years old, he reported to a street dance organization and paid a one-time discount for two years, which was cheaper by more than 10,000 yuan. But the next year, the store closed down, and at least half of the courses were missing. Many parents who suffered losses chose to go through legal procedures, and eventually the lawsuit won, but this institution simply had no money to pay for the parents’ losses. " Miao Qing, a parent from Henan, said that now two years have passed, and the refund is far away. The person in charge of this institution has always said, "There is no money now, and I am making money to pay off my debts".

According to Yao Jinju, a professor at Beijing Foreign Studies University and executive director of Beijing Education Rule of Law Research Base, there are many reasons for overcharging by training institutions. First, training institutions are essentially profit-seeking. Second, parents are prone to impulsive consumption when faced with the marketing routines of training institutions. Third, national policies are currently in a period of dynamic adjustment. It is not excluded that some off-campus training institutions want to "make a fortune" before the policies are fully implemented.

Yao Jinju said that in order to achieve better supervision effect, relevant departments should continue to adhere to the principles of public welfare, individualization and classified governance of off-campus training and curb the barbaric growth trend of off-campus training.

Control class time limit charges

Merchants still sell big school bags.

In fact, in order to prevent problems such as "difficulty in refunding fees" and "running away with money", the education department has already made relevant regulations on pre-payment of off-campus training institutions. In October, 2021, the Ministry of Education, the National Development and Reform Commission, and the People’s Bank of China issued the Notice on Strengthening the Supervision of Pre-payment of Off-campus Training Institutions, clearly requiring that "training for primary and secondary school students should not be paid by means of training loans. The charging period of off-campus training should be consistent with the teaching arrangement, and it is not allowed to collect fees in a one-time manner or in the form of recharge or sub-card, which spans more than 3 months or 60 class hours. "

In December 2022, thirteen departments, including the Ministry of Education, issued the Opinions on Standardizing Non-disciplinary Off-campus Training for Primary and Secondary School Students (hereinafter referred to as the Opinions), which once again emphasized the above provisions. At the same time, in terms of the amount of one-time charges, the Opinions added a provision that one-time charges should not exceed 5,000 yuan to prevent excessive one-time charges from increasing capital risks and parents’ burden.

However, the reporter randomly selected 10 non-discipline training institutions for investigation and inquiry, and found that almost all of them had the problem of over-charging and over-time charging, including children’s programming, physical fitness, swimming, tennis, street dance, skiing, equestrian, fencing and dancing.

For example, Xiong Xiaomi Children’s Swimming Pool (North Garden Store), the reporter came to the offline store as the parents of the students to ask about the curriculum system and charging standards. Among them, the price of water training course is much more expensive than that of water swimming course, and the class hours and validity period of the course package are longer. Its course package is divided into 24 times, 48 times and 96 times. After the corresponding original prices of 11,952 yuan, 23,904 yuan and 47,808 yuan are crossed out respectively, and the corresponding discounts are counted, the membership prices can be purchased at 7,162 yuan, 11,826 yuan and 18,986 yuan.

The reporter said that the child is now 5 years old, and the sales consultant immediately recommended a course package that is enough to buy 96 times, and its validity period is 18 months. The consultant said: "The more class hours, the more comprehensive children will learn, and the more class hours, the cheaper the average price." Facing the reporter, "What effect can you achieve after 96 times of study?" Asked, the consultant hesitated and said, "at least make sure the child can learn breaststroke."

The course package of Kung Fu Babe Martial Arts Fighting Fitness Hall is directly "big" to 200 class hours. According to the introduction of the staff of the organization, 48 class hours are about 10,000 yuan, and the discount for 200 class hours for larger-capacity course packages is very strong, and 20,000 yuan can be won.

In Happy Pony Children’s Equestrian Club, the unit price of mid-week class is from 600 yuan to 700 yuan, and the unit price of weekend class is about 800 yuan, including horse fee and coach fee. In the middle of the week, the class package is relatively cheap. The special class package is 18,000 yuan for 24 classes and 39,800 yuan for weekends.

"This is the market price, which is not expensive here." "This project is very popular, many parents bring their children to school, and there are discounts for on-site registration." "We don’t have to worry about the problem of running away from the road due to thunder. We are a big institution and there will be no financial security risks." … … This is the same marketing term that the reporter encountered in the investigation of non-discipline training institutions, and its purpose is also to promote the big course package.

In this regard, Cai Hailong, deputy dean of the Institute of Education Policy and Law of Capital Normal University, believes that the regulatory requirements of the relevant departments on the charging standards and charging methods for off-campus non-disciplinary training have not been well implemented and implemented. One of the most important aspects is that the current educational administrative law enforcement mechanism is not perfect and perfect. Generally speaking, if a policy is to be implemented, it is necessary to translate relevant policy propositions into clear legal responsibilities, provide clear legal basis for relevant administrative subjects, need a considerable number of personnel with law enforcement qualifications, and have practical law enforcement procedures to ensure legitimacy and legality.

Chu Zhaohui, a researcher at China Academy of Educational Sciences, believes that what any regulatory department and industry association can do is always limited. If we can combine supervision with industry self-discipline, it may have a certain effect on controlling the chaos in the off-campus training market of non-disciplines. For training institutions, it is necessary to make their actions as open and transparent as possible, which is also an important aspect to improve their credibility. Parents should also be cautious about all kinds of preferential policies put forward by merchants, and don’t have the psychology of being greedy for cheap.

"In the process of formulating specific policies, we can distinguish the actual situation of different types of off-campus training in different regions and design more targeted overcharging standards through in-depth research and starting from practice. For example, some art courses have high fees for a single class, and the duration of each class is different from other types of courses. You can consider making some differences from the policy. " Yao Jinju said.

Charging behavior needs to be standardized

There are loopholes in fund supervision

The reporter noted that in the tips issued by the Ministry of Education and the China Consumers Association for off-campus training, it was specifically mentioned that it is necessary to pay attention to the safety of payment, complete the training payment through the national off-campus education and training supervision and service comprehensive platform, and never pay the training fee by means of transfer or cash. To any account other than the pre-paid fund supervision account.

However, after interviewing 10 parents from Beijing, Henan, Anhui and other places, the reporter learned that these parents usually use credit cards or WeChat or Alipay to transfer money. As for the national off-campus training payment platform "National off-campus education and training supervision and service comprehensive platform", they all said that they had never heard of it and the agency staff had never introduced it, so they "don’t know where their money has gone".

In the rights protection group provided by Miao Qing, a parent showed his transfer record at that time. The parent swiped a credit card to pay 5,100 yuan, and the account shown in the order was named "Henan Futian Department Store", but the transaction type was "car refueling". According to the memory of this parent, the staff of this street dance organization was also very confused at that time, but the answer given by the other party was vague "that’s it".

Yao Jinju told reporters that the national comprehensive platform for off-campus education and training supervision and service is sponsored by the Ministry of Education, and the website is operated and maintained by the Education Technology and Resource Development Center of the Ministry of Education (Central Audio-visual Education Center). The construction of the platform mainly solves three problems. First, it serves the administrative departments in terms of institutional qualification, training content, funds and service quality supervision. The second is to serve off-campus training institutions and build a platform for their annual inspection services, opening stores, selling course services, information release services and consulting services; The third is to serve the parents of students, provide convenience for them to choose compliance institutions, purchase classes, make appointments, cancel classes, refund fees, and evaluate them. At present, local education administrative departments at all levels have been able to conduct daily supervision, risk verification, real-time tracking and online scheduling management of off-campus training institutions online. Parents can register through the platform website or mobile App.

"Parents should rationally choose training programs and training institutions, establish awareness of risk prevention, and be alert to false propaganda. We must complete the training payment through the national comprehensive platform for off-campus education and training supervision and service. " Yao Jinju said that the national comprehensive platform for off-campus education and training supervision and service has the functions of "course verification" and "application for refund".

How can we further standardize the behavior of training fees and strengthen the supervision of pre-paid funds for off-campus training?

Xiong Bingqi, president of 21st Century Education Research Institute, believes that relevant departments should serve and guide non-discipline training institutions to standardize their operations, understand the training needs of parents and children, and can’t solve problems simply by shutting down, and the regulatory measures should be good governance. We should think about what is good regulation, good supervision and good social governance from the perspective of the rule of law. A good supervision will make the market more standardized, legal and compliant institutions get better development.

"It is necessary to clarify the regulatory responsibilities of relevant subjects, establish an institutional mechanism of multi-sector coordinated law enforcement led by the education department, and pay special attention to the role of market supervision departments and financial management departments." Cai Hailong suggested actively promoting the collation and revision of relevant laws and regulations, local regulations and normative documents, and forming a necessary list of powers and responsibilities to provide a clear legal basis for relevant management departments to carry out supervision according to law.

Cai Hailong also called for further optimization of supervision methods. In view of the problems of overcharging and prepayment in training institutions, we should strengthen consumers’ risk awareness and avoidance ability by carrying out relevant publicity and rule of law education; Establish a law enforcement mechanism for daily supervision, and increase the frequency and density of investigating illegal charging behaviors. If necessary, you can use the national comprehensive platform for off-campus education and training supervision and service to collect fees.