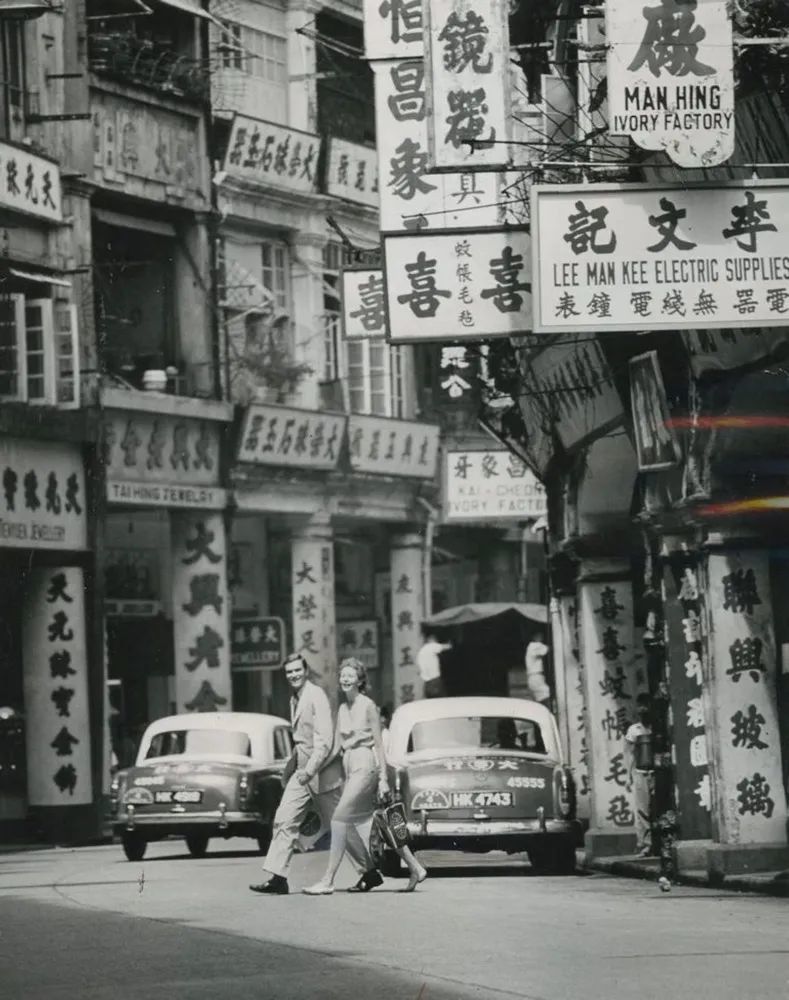

Today is the 25th anniversary of Hong Kong’s return to the motherland.

Concerned about Hong Kong’s society and culture, we can’t avoid Hong Kong’s literature.

In 1921, Shuangsheng magazine was founded, and people began to write novels in semi-vernacular with Hong Kong as the background. Until this year, Hong Kong, China’s modern literature has gone through one hundred years.

In Hong Kong, where pop music and movies are the main cultural products, literature does not seem to be particularly concerned. However, as a unique existence in China’s modern and contemporary literature, Hongkong literature has its own style and charm.

For the motherland, Hong Kong literature is a "surprise".

Wang Dewei, a professor of East Asian Department of Harvard University, once said: "Located in the south, this land was once a place where colonial forces were located, and it was difficult to form a stable literary production field with political swings and mixed cultures." At the same time, "the rapid consumption transformation from economic capital to cultural capital" has set many obstacles for Hong Kong literature to form its own style and characteristics.

However, looking back over the past hundred years, several generations of writers "have created one legend after another with their hard work."

For those writers who live in Hong Kong and create Hong Kong literature, the significance of writing Hong Kong literature lies in: providing fables, observations and interpretations for the city continuously, recording people and things here, and writing the subtle life situation and spiritual space of Hong Kong people.

It was Hong Kong literature that first "literated" Hong Kong-

Without Liu Yichang’s novels, there would be no lingering and bizarre streets in Wong Kar-wai’s films.

Without the creation of Jin Yong and Liang Yusheng, there would be no people and rivers and lakes of the Eastern Martial Arts;

Without the wonderful pen of Zhang Ailing and Huang Biyun, there would be no subtle and touching "Hong Kong style" love …

Today, let’s review the representative writers and works of Hong Kong literature in the past century.

1920s

Lu Xun’s visit to Hong Kong and Iron Horse

The earliest Hong Kong literature

In 1921, the literary magazine Shuangsheng was founded. The editors of the magazine, Huang Kunlun and Huang Tianshi, were both young writers of the new trend of thought. They wrote Hong Kong stories in semi-vernacular, which is called "free-footed", and expressed their ideas of anti-feudalism, personality liberation and free love, which constituted the first glimmer of Hong Kong’s early new literature.

Six years later, with the staged victory of the Northern Expedition, the old forces and warlords were overthrown, the new literature movement in the Mainland flourished, and works of various genres were gradually imported into Hong Kong.

In February, 1927, Lu Xun was invited from Guangzhou to Hongkong to give two speeches, entitled Silent China and Old Tune Finished.

In his speech, Lu Xun said: The old culture made people tell old sayings in difficult ancient Chinese, and most people couldn’t understand them, which was equivalent to silence. He advocated that modern people should speak their own modern words and turn silent China into a talking China.

Lu Xun’s speech aroused the panic of the Hong Kong authorities and feudal old-school literati. They first "sent people to ask for admission tickets and collected them so that others could not listen;" Later, the speech was not allowed to be published in the newspaper. As a result of negotiations, it was cut and changed a lot. "

However, young people in Hong Kong still responded enthusiastically to Lu Xun’s speech.

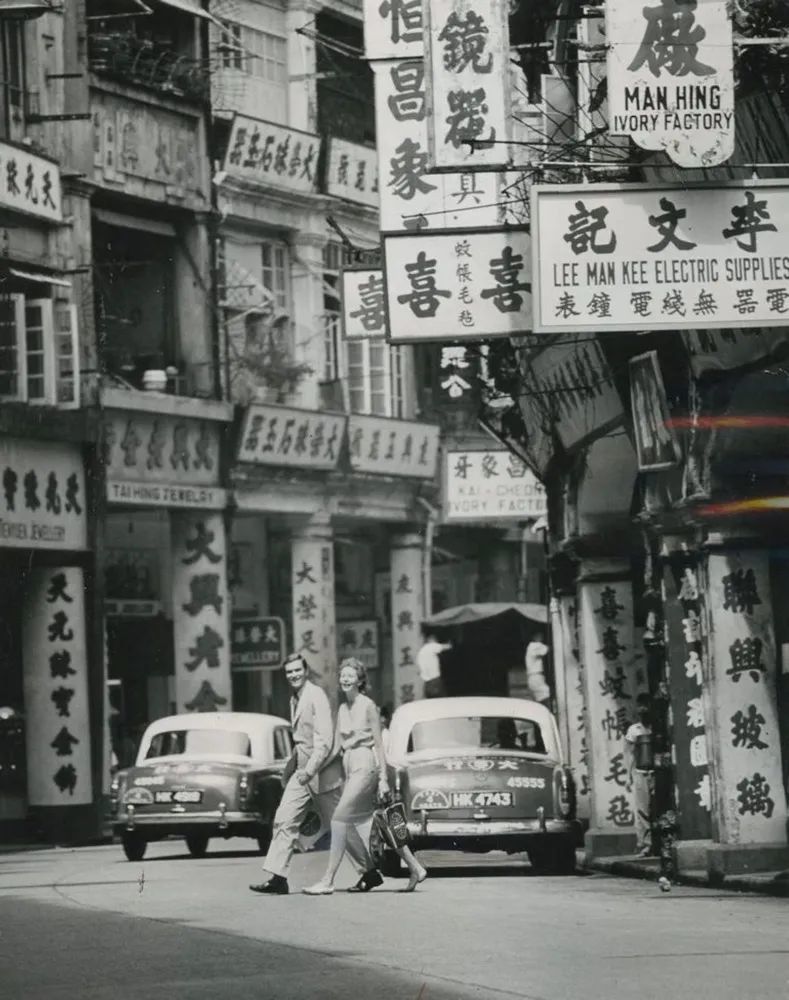

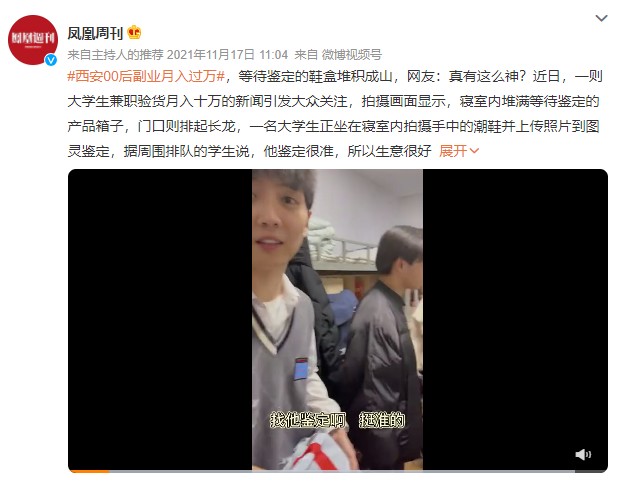

Hong Kong in Colonial Period

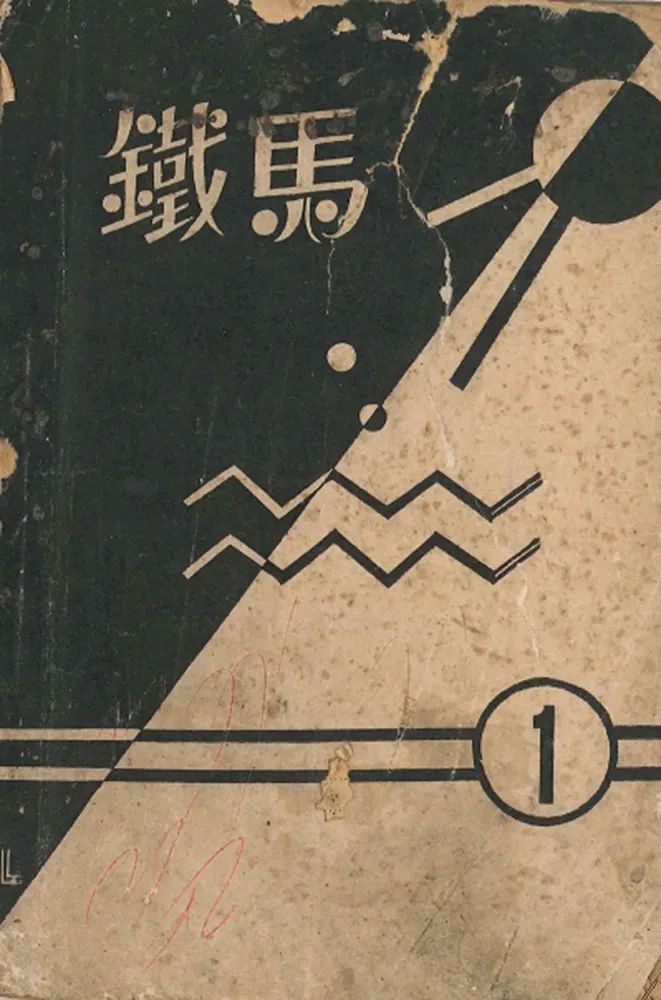

After that, many new literary groups and publications appeared one after another, which is proof. Among them, the most important is the pure literary publication Iron Horse, which was founded in 1929, and it marked the official appearance of Hong Kong’s new literature.

"Iron Horse" wrote:

"We put our machine guns and cannons to deal with the fists of antiques, and beat him out of the water. They are the laggards of dynasties, the demons of the world, and the Uber of literature. If we keep them, we will never turn over. Young literary friends, this is a job that has passed, but it is a brand-new job in Hong Kong. This requires our joint efforts. New literary warriors, this is the first cry of Hong Kong culture! "

In Iron Horse magazine, 18-year-old Lu Lun published the novel Fireside. This novel, wrote down the poverty of Hong Kong literature youth-

Puya Street is a rundown street in Hong Kong. There are no footprints of gentlemen and ladies, no music in the square, and no municipal surveyors and engineers have been here. On winter nights, people who live here feel that everything is cold psychologically. "The cold rules together, because the street is narrow, the wind blows especially hard, and the door that is not tightly closed and the six buttons that are not tightly assembled make a slight earthquake. Like this huge house, it can’t resist the cold wind, and its teeth are chattering."

In this poor street, there lived two young Hong Kong writers, T and K, writing in the cold. They usually write articles for newspapers and rely on the payment settled at the end of the month to make a living. It is very sad to live by pen and ink. There are many newspapers in Hong Kong, but most of the publishing sites are occupied by a few people. Those poor people who can’t curry favor with the editor-in-chief are reduced to a dangerous level, and sometimes they can’t even eat bread. T "has lived here for half a year, and not a day goes by without him struggling in pain." At first, he lived in a better place. Later, one or two more reliable newspapers were unexpectedly closed, and he moved to this dirty Puya Street at the suggestion of his friend K, just next door to K. "

Lv Lun, the first generation of new literature writers in Hong Kong

Because of the repeated delay in the payment of the manuscript, T’s rent can no longer be paid, his wife has been humiliated by the landlord, and the rice has bottomed out. The fire wine, foreign candles, ink and even manuscript paper have all gone, and there is nothing to sell at home. He can only stay up late to write and expect to get this month’s statement the next day. The next day they went to ask for the manuscript fee, but the newspaper office still asked him to "spend a few days." In the last part of the novel, I turned to write A, the literary editor of three newspapers in Bendu. The manuscript written by the author who worked so hard to stay up late was not a serious matter to him at all. Last year’s manuscript, he delayed reading it by the fire until now. When his wife came over to make out, he threw the manuscript aside and fell into the stove. "When the stove lit up, they felt a burst of warmth and their arms hugged each other more tightly."

-Zhao Xifang’s "The First Shout of Hong Kong Literature"

The style of the novel is gloomy, and it is impossible to write such words without deep experience of the life of cooking words to cure hunger in Hong Kong. Poor writers pointed the contradiction at newspaper editors, but in fact, the root of Hong Kong’s underdeveloped new culture at that time was its social nature.

After his visit to Hong Kong, Lu Xun returned to the mainland and wrote about the gloomy social outlook of colonial Hong Kong-

"Although Hong Kong is only an island, it vividly depicts the present and future of many places in China: several foreign masters in the central government, under whom are a number of" higher Chinese "who praise virtue and a group of enslaved compatriots. In addition, they are all "natives" who suffer silently. They can die in the foreign market and escape into the mountains … "

-Lu Xun’s "Just Set" and "Let’s Talk about Hong Kong"

The British occupation of Hong Kong was originally for the sake of trade, and it was not intended to encourage Hong Kong to develop its own culture. What was more concerned was how to spread British culture and values here.

In such a social system, the way out for pure Chinese literature is hard to find. At that time, the young literary people who founded Iron Horse had the naive idea that if the first issue was printed, the second issue could be published by relying on the sales income, so as to maintain the magazine. However, The Iron Horse didn’t sell, and it died in the first issue.

Of course, the economy is one of the reasons for the suspension of the publication of Iron Horse, but as Lu Lun said: "The main reason is the lack of social environment that allows them to survive."

In the 1930s, the activities of Hong Kong literary youth did not stop. Between 1931 and 1937, other publications such as Riptide, Spring Thunder, Today’s Poetry and New Life came out.

Although the literary youth in Hong Kong during this period were still learning Yu Dafu’s style, imitating Shen Congwen’s novel techniques and experiencing Xu Zhimo’s poetic expression, most of them borrowed stones from other mountains to express their dissatisfaction with the reality of colonial society and their personal feelings, thus slowly forging a path.

The Iron Horse was founded by the Island Society in September, 1929.

1930s-1940s

Xiao Hong, Zhang Ailing, Dai Wangshu

Literature and War

After 1937, due to the outbreak of War of Resistance against Japanese Aggression, many mainland writers came to Hong Kong to engage in cultural work, which made Hong Kong a small "cultural center" for a time.

Many important writers in the history of modern literature in China, such as Ba Jin, Mao Dun, Xu Dishan, Dai Wangshu and Xiao Hong, all wrote in Hongkong.

In 1938, Dai Wangshu presided over Constellation, a supplement to Sing Tao Daily, which developed this platform into a cultural starry sky of Hong Kong’s new literature and also became a literary lighthouse in China during the Anti-Japanese War. Mao Dun, Shen Congwen, Yu Dafu, Bian Zhilin, Guo Moruo, Ai Qing, Xiao Jun, Xiao Hong, Xu Chi and others all published their works here, as Dai Wangshu himself said: "Wen The writers in exile in Hong Kong are also constantly contributing manuscripts. We can actually say that there is no well-known writer who has not written an article in Constellation. "

On December 8, 1941, after the Pearl Harbor incident, the Japanese army quickly invaded Hong Kong. On this day, the University of Hong Kong just held the final exam. When the female student Sheng Jiuli and her classmates were preparing for the exam, they heard that the war broke out, and they were suddenly liberated.

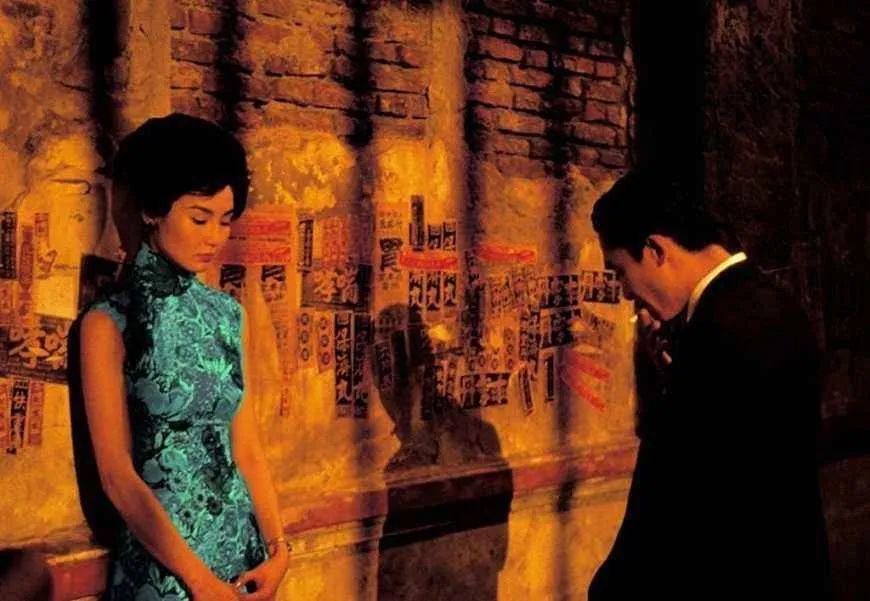

At the same time, a pair of men and women in troubled times, Fan Liuyuan and Bai Liusu, were talking about love. At the stage of stalemate, Japanese artillery shells came, and they suddenly knew the necessity of falling in love with the whole city in troubled times.

This is of course the plot in Zhang Ailing’s novels.

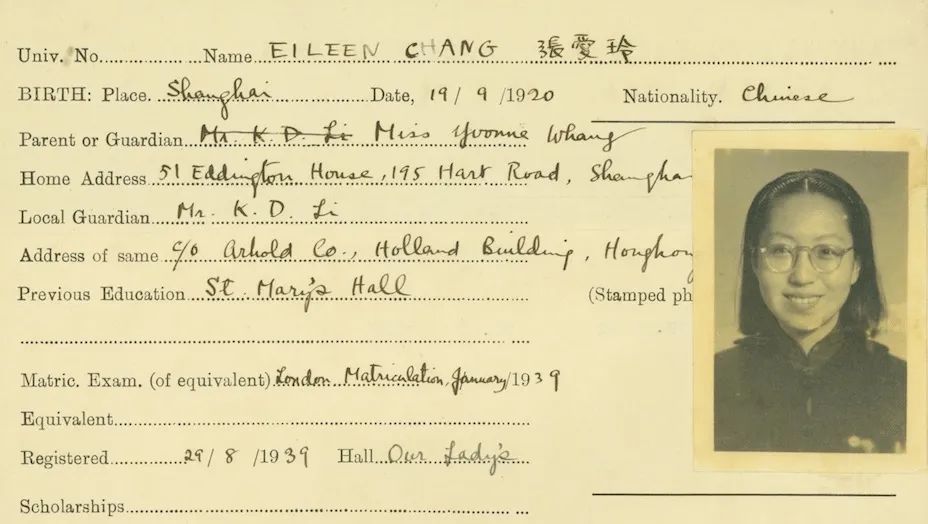

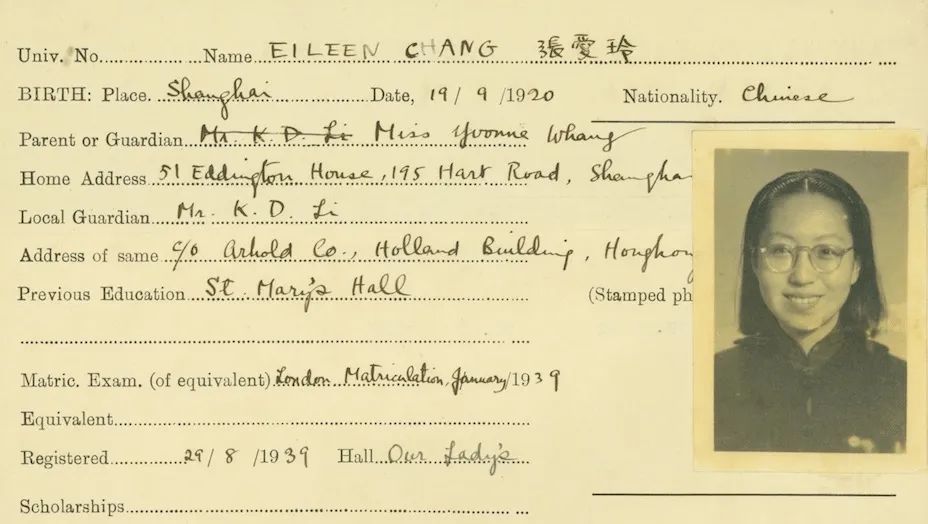

Zhang Ailing’s School Record in Hong Kong University

Zhang Ailing went to Hong Kong University to study in 1939, and her experience in 1941 became a lingering historical mark in her creation. And when historical events collide with the love described by Zhang Ailing, the meaning of the story appears-

It was December 7, 1941, December 8, and the gun rang. Between one shot and another, the silver fog in the winter morning gradually dispersed. On the top of the mountain and in the ravine, the residents of the whole island looked at the sea and said, "Let’s fight, let’s fight." No one can believe it, but after all, it is a war.

Tassel stayed alone in Babington Road, and she didn’t know anything. When Ali got the news from her neighbors, she woke her up hastily, and the outside had entered the stage of fierce fighting. There is a science experiment hall near Babington Road. Anti-aircraft guns are mounted on the roof, and stray bullets keep flying over, screaming, "Cheep, yo, er, er, er …" and then "bang" and falling to the ground. The sound of "creaking, uh, uh, uh …" tore the air and tore up the nerves.

The pale blue sky was torn into strips and fluttered in the cold wind. There are countless cut nerve tips floating in the wind at the same time.

……

Tassel also thought of Liuyuan, wondering if his ship had sailed out of the port and been sunk. But when she thinks of him, she feels a little slim, like a lifetime ago. Now this paragraph has nothing to do with her past, like a radio song, halfway through, suddenly affected by the bad weather, it crackled and exploded, and when it was over, the song still had to be sung, and I was afraid it was over, and the song had been sung, so there was no need to listen.

-Zhang Ailing’s "Love in the Whole City"

Film stills of "Love in a Fallen City"

1950s

Jin Yong and Martial Arts

Adult Fairy Tales and the Roots of China Culture

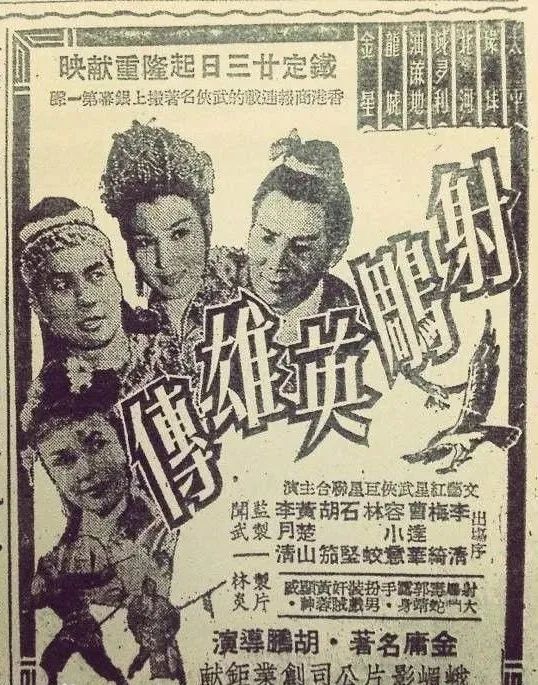

From many books about Hong Kong’s anecdotes, it can be seen that since Hong Kong opened its port in 1842, its public security did not show signs of improvement until the middle of the 20th century, so there has always been an atmosphere of martial arts among the people. In 1953, Wu Gongyi, the head of Tai Ji Chuan, competed with Master Chen Kefu, the master of Baihequan, which became an important cultural event among the people.

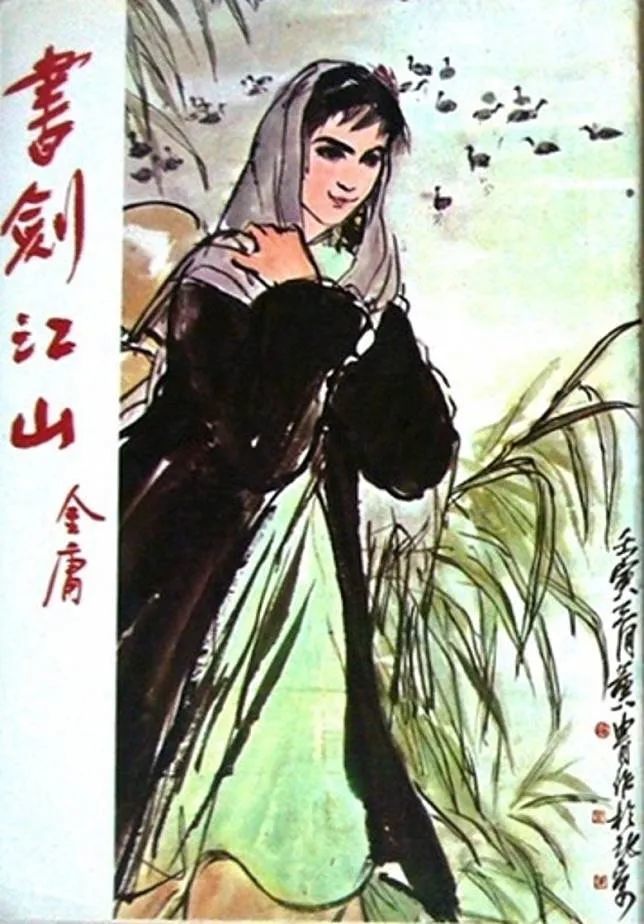

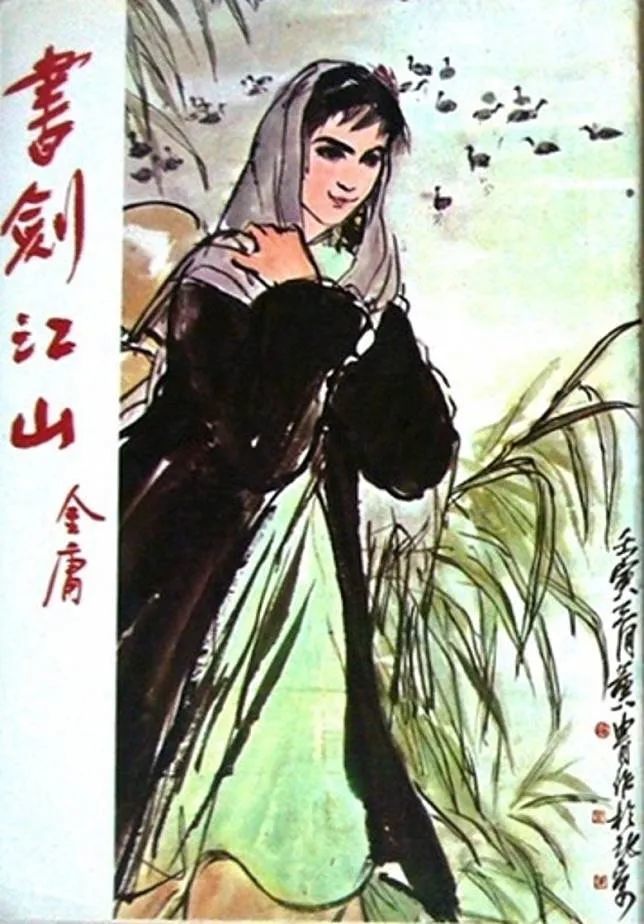

Inspired, Luo Fu, editor-in-chief of New Evening News, tried to create a serial column of martial arts novels in the supplement, inviting Chen Wentong and Cha Liangyong, who can write and edit, to appear. Chen Wentong wrote the first martial arts novel "Long Hudou Jinghua" under the pseudonym Liang Yusheng, and Cha Liangyong wrote the first martial arts novel "Shu Jian An Qiu Lu" under the pseudonym Jin Yong.

It was an instant hit, and the sales of New Evening News doubled, which made Liang Yusheng and Jin Yong famous, thus forming the beginning of folk political literature based on the left wing in Hong Kong.

Jin Yong and Liang Yusheng

Jin Yong came to Hong Kong in 1947 and worked as a translator in Ta Kung Pao. At first, Jin Yong didn’t like Hong Kong. He once described his feelings when he first arrived in Hong Kong: "It’s a bit like being in a rural place." But it soon changed: "But generally Hong Kong people are frank, confident and reliable, and I like them soon."

In 1950s, there were many migrants in Hong Kong. They were not all intellectuals, but more working class. However, they all had the same characteristic, that is, their desire for martial arts-themed books.

In their eyes, compared with the Central Plains cultural soil in the Mainland, Hong Kong is undoubtedly barren. In addition, Hong Kong was ruled by the British, which prompted the emergence and outbreak of national sentiment in their hearts, and they all had a strong interest in books, movies and music of China’s traditional culture-these "spiritual food" could help strangers in a foreign land dispel their complex feelings of being in a colony.

Jin Yong’s novels can fully embody this function. They are not only consumer goods, but also have the elements of "resistance" of martial arts. For the Hong Kong public at that time, they are a kind of reading materials with the function of filling and repairing.

At that time, readers not only had a soft spot for martial arts novels, but also had deep feelings for the China culture involved.

The cultural elements of China in Jin Yong’s novels can be said to be very diversified. Poetry, religion, martial arts, five elements, Taoism, calligraphy and painting are all important tools to convey China culture, and they are also important elements of traditional China martial arts novels.

Huang Yaoshi, the East Evil in The Legend of the Condor Heroes, is a figure who knows the essence of China culture. He is proficient in piano, chess, calligraphy and painting, and in medicine, and he knows everything, not to mention his unique skills in literature and martial arts. Novels often borrow his daughter Huang Rong to prove his father’s superiority. For example, when Guo Jing and Huang Rong first arrived in Lujiazhuang, Huang Rong expressed his paintings and inscriptions on the wall of the study, and made a clear statement-

Huang Rong saw that the study was full of beautiful things in eyes, full of poems and classics, and there were many bronze and jade articles on the table. It seemed to be full of antiques, and there was an ink painting on the wall, which showed a middle-aged scholar standing in the atrium on a moonlit night, with his hand on the hilt, looking up at the sky and feeling lonely. There is a word in the upper left corner:

"Last night, I couldn’t stop singing. It’s already midnight. Get up and walk around the steps alone. People are quiet, and the moon is bright outside the curtain.

White head is fame. The old mountain pine and bamboo are old, which hinders the return journey. I want to pay my heart to Yao Zheng, but I have few bosom friends. Who will listen to the broken string? "

……

When the landlord of the land saw Huang Rong’s close examination of the picture, he asked, "Brother, how about this picture? Please read the title." Huang Rong said, "Don’t dare to talk nonsense, Master Zhuang." Lu Zhuang said, "Brother, just say it’s okay."

Huang Rong said, "The picture of Master Zhuang shows Yue Wumu’s feeling of being unable to stretch his ambition and being at a loss when he wrote this poem" Small Mountains ". It’s just that Yue Wumu’s ambition is for the country and the people, and the phrase "Whitehead is fame" may be the meaning of avoiding suspicion and raising bad luck. At that time, the monarch and his subjects in the DPRK all wanted to make peace with the Jin people, but Yue Fei insisted, but unfortunately no one listened to him. With few bosom friends, who will listen to the broken string?’ These two sentences are said to mean that in this case, it is a helpless mood, but it is not openly against the court. When the master of Zhuang painted and wrote, he seemed to be angry and full of twists and turns. Although his brushwork was extremely vigorous, he was sharp-edged, as if he wanted to fight a life-and-death battle with his great enemy, for fear that it was slightly different from Yue Wumu’s original intention when he was worried about his country and hurt his country. Xiao Ke once heard people say that calligraphy and painting, if it is too powerful and lacks the meaning of roundness, seems to have not yet reached a very high level. "

After listening to these words, Lord Lu Zhuang sighed, looked mournful and remained silent for a long time.

-Jin Yong’s Legend of the Condor Heroes

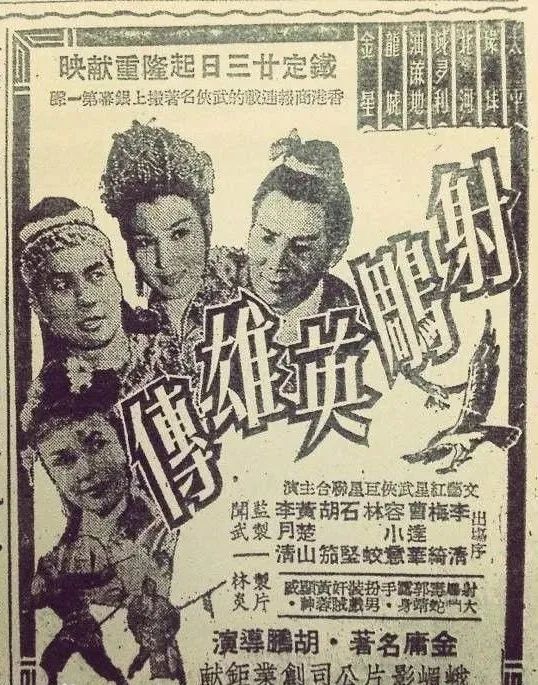

58th Edition Poster of Legend of the Condor Heroes

In the 1950s, the living conditions in Hong Kong were low, and most people in Hong Kong lived in extreme poverty. Only a few British people in Hong Kong hold high positions and lead a luxurious life. Ordinary people have no affection for the British government in Hong Kong, and at the same time they are powerless to resist, so they care more about the "roots of China culture", which is also the reason why the new martial arts novels in Hong Kong spread rapidly in the 1950s. For the people, martial arts novels are "adult fairy tales", which can relieve the pressure brought by real life and soothe their homesickness.

In the 1980s, Jin Yong’s novels were introduced to the mainland, and readers completed a new round and a wider range of cultural root-seeking through martial arts stories. However, that is another story.

1960s

Liu Yichang, Modernism.

Wong Kar-wai’s literature teacher

If Jin Yong is a master in the field of popular literature in Hong Kong, there is another master in the field of serious literature in Hong Kong, that is, Liu Yichang.

Liu Yichang’s name is unknown to many people. The word "chàng" is very rare. If you don’t look it up in the dictionary, few people will immediately pronounce it correctly.

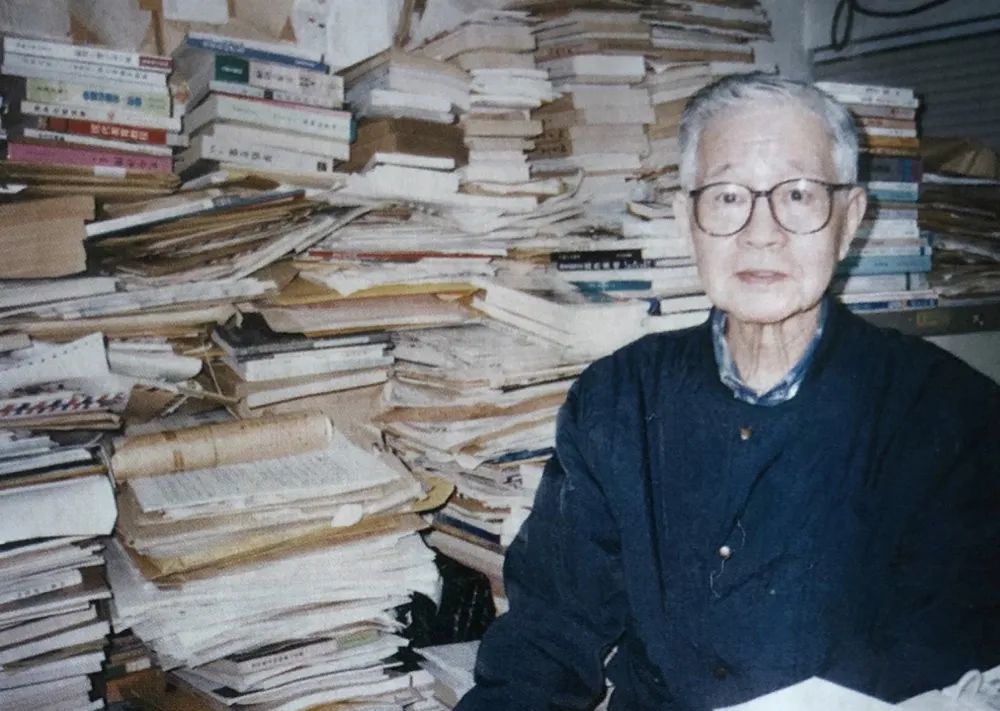

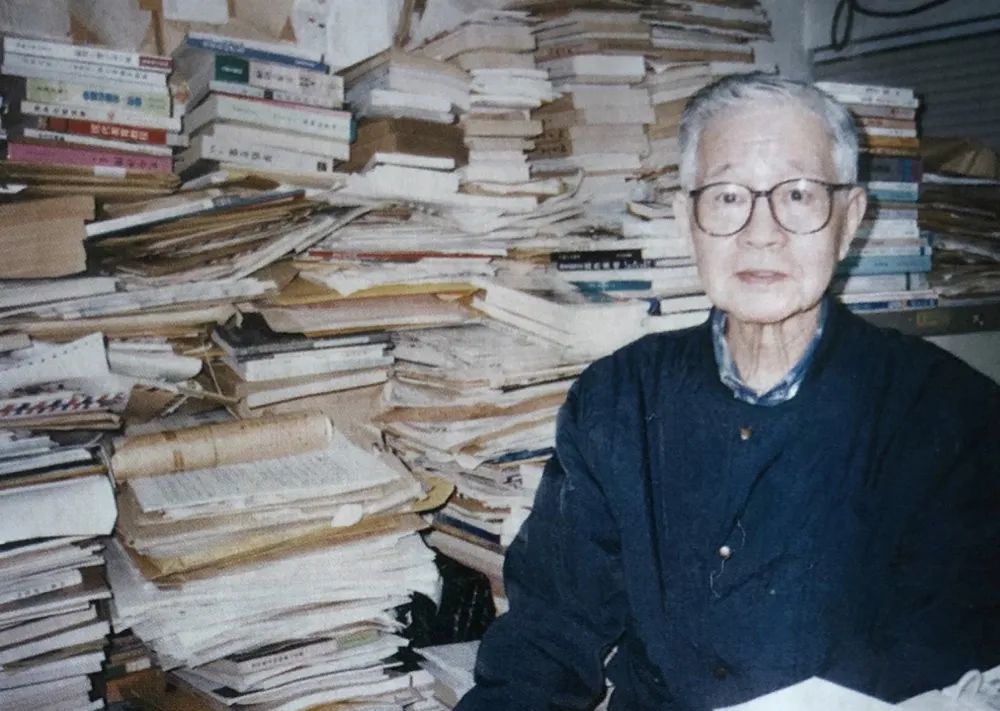

Writer Liu Yichang

But in the Mood for Love directed by Wong Kar-wai is well known. Wong Kar-wai once said that he drew inspiration from Liu Yichang’s long stream-of-consciousness novel "Dui Dao" when he made this nostalgic film of absolute beauty. It can be said that Liu Yichang is a literature teacher in Wong Kar-wai.

In February, 1960, Liu Yichang, a young writer, took over the supplement of Repulse Bay of Hong Kong Times, and immediately set out to create a "modernist school" of Hong Kong literature. He published a large number of works by Woolf and Joyce, and actively translated and introduced the theory of stream of consciousness.

At the same time, in order to meet the needs of life, he has to write a large number of popular novels to meet the needs of the market, often writing more than ten newspaper serial novels a day, as he said: "To accommodate readers and write novels they like to read." Therefore, during the day, he writes works that entertain others, and at night, he writes his favorite novels when he is free. His serious literary works "The Drunken" and "Dui Dao" were created in this way.

In 1963, Liu Yichang published the novel The Drunken with obvious autobiographical color. The novel boldly used the artistic techniques of western modernist novels such as stream of consciousness and symbolism to describe the wandering, struggling and sinking of the "I" of the "Drunken" in the two postures of sobriety and drunkenness, so as to depict the living dilemma and sensitive and complicated inner world of the urban people (more accurately, urban intellectuals) in Hong Kong. This work is also known as "China’s first novel of stream of consciousness".

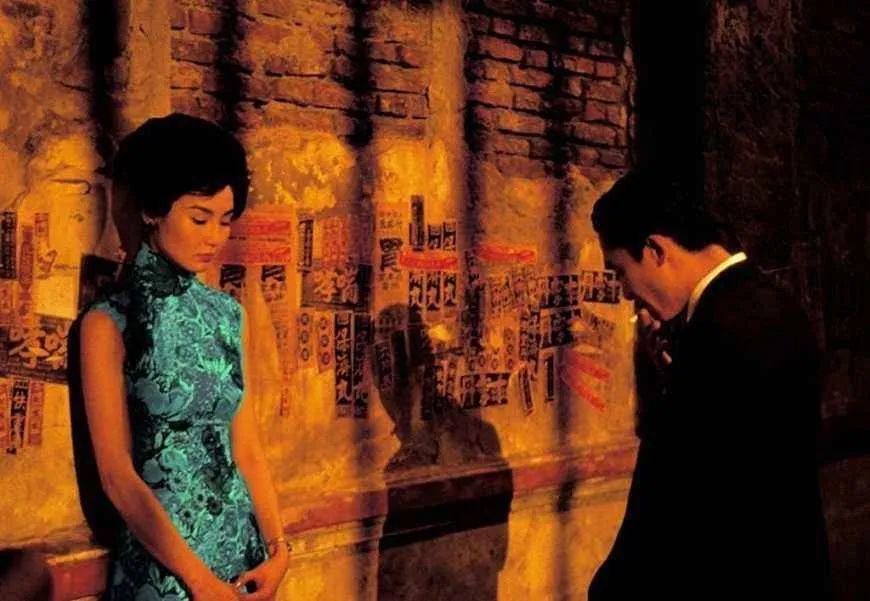

Stills of In the Mood for Love

In 1972, Dui Dao was published. In fact, there is not much story in the novel. The two protagonists, Chun Yubai and Yaxing, don’t know each other and have never talked. The novel only describes the two lives they lead on Nathan Road, and the only overlap is the inverted state formed by Chun Yubai’s memory of the past and Yaxing’s imagination of the future, which is a relatively novel structural technique in Chinese novels-

one

When the No.102 bus entered the Cross-Harbour Tunnel, Chun Yubai remembered something more than twenty years ago.

Twenty years ago, Hong Kong had a population of just over 800,000. Now the population of Hong Kong is close to 4 million. Many desolate places have become lively resettlement areas. Many old buildings have become skyscrapers.

He can’t forget flying from Shanghai to Hong Kong more than twenty years ago. When he got on the plane, he was wearing a thick fur robe. When he got off the plane, he saw many Hong Kong people wearing only a white shirt. This place is not very cold in winter. Even on Christmas Eve, people still eat ice cream at the table.

Chun Yubai came to Hong Kong from the north on Christmas Eve. The war to the north of the Yangtze River is getting more and more fierce. The frenzy of golden coupons made the people unable to breathe. Shanghai is under the pressure of war and in turmoil. Many people have come to the south. Some settled in Guangzhou, while others chose Hong Kong.

Chun Yubai has never been to Hong Kong, but intends to move to Hong Kong. There is only one reason to do this: the Hong Kong dollar is a stable currency. When Chun Yubai came to Hong Kong from Shanghai, one dollar could be exchanged for six Hong Kong dollars. Now, you can only change it to five six two five.

two

Most of the wooden ladders in old buildings have been eaten by termites, and when you step on them, there will be a squeaking sound. These wooden ladders should have been repaired or replaced long ago. No repair, no replacement, because the owner has sold this old building before the war to the real estate company that is expanding in major events at a high price. This is what menstruation told Yaxing.

Menstruation of Yaxing has lived on the third floor of this old building for more than twenty years. Yaxing and menstruation have a very good relationship, and they always walk around when they have nothing to do. Now, when she walked down the wooden ladder, she had a Sydney in her hand. Menstruation gave her this Sydney. Yaxing walked out of the old building, and it was the time when Chun Yubai took the bus and entered the cross-harbour tunnel.

Turn into the street and smell an unpleasant smell. There is a public toilet here, so that every passer-by walking in this street must cover his nostrils with a handkerchief or palm. Yaxing doesn’t like this crosswalk because it has public toilets. Every time I pass by the public toilet, I always miss this:

"In the future, if you get married and find a house, you must have a good environment. There must be no public toilets nearby."

-Liu Yichang’s "Down"

French poster of In the Mood for Love

Without Liu Yichang, it is hard to imagine what Wong Kar-wai’s 2046 and In the Mood for Love would be like. In the Mood for Love, in a sense, is a film interpretation of Dui Dao. When filming, Tony Leung Chiu Wai never got into the atmosphere of the 1960s. In order to capture the feelings of the times, Wong Kar-wai suggested that Tony Leung Chiu Wai imagine Liu Yichang in the 1960s.

Liu Yichang’s cultural demeanor at that time was the cultural meaning that Wong Kar-wai wanted to express. Liu Yichang foresees many possibilities for the interweaving between Hong Kong’s social culture and literature, and his works are also worth reading and rereading.

1970s

Xixi’s My City

Cities are alive, how can they remain the same?

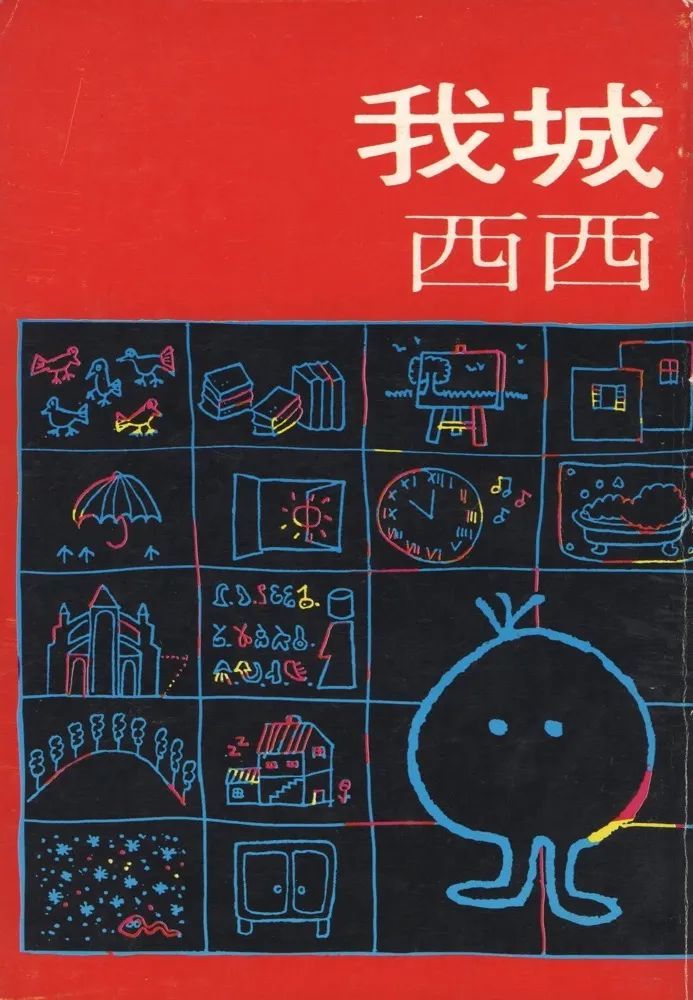

In 1975, writer Xixi serialized the first important novel My City in Hong Kong Express. Now, it has already become a classic of Hong Kong literature.

Xixi was born in Shanghai in 1938. In 1950, he came to Hong Kong from Shanghai with his family to attend junior high school. The martial arts films in the cinema and Cantonese in the classroom opened a new world for her.

After graduation, she became a primary school teacher. "At that time, there were too many teachers and too few students. I retired in my thirties. At that time, I will either transfer to the post office or the zoo to work or retire, and I will retire. "

Since her retirement, she has been specializing in literary creation. According to herself, her pen name is hieroglyphics. "Xixi" is a girl in a skirt standing in a square grid with her feet on the ground. "Xixi" means jumping off a plane, which is a game she liked to play when she was a child.

Writer Xixi

My City, a 160,000-word novel, is Xixi’s masterpiece. Scholar Wang Dewei once commented that "Xixi made a naming ceremony for Hong Kong’s subjectivity in the form of literature."

Ma Shifang, a Taiwan, China writer and music radio program host, attended the college entrance examination and saw the cover of My City in the bookstore. He opened it curiously and was fascinated when he saw the beginning.

"I nodded my head to them. Yes, what can I say except nodding my head to them?"

-Upside-down, collage and remodeling. In Ma Shifang’s impression, this novel is neither bitter nor shallow. Although it was written in the 1970s, the freshness of the language is still like making very powerful pop music, and it is not out of date.

In Xixi’s view, "what I want to write is my specific and subtle thoughts and feelings at the moment, and I am very concerned about how to write." Hong Kong has been changing, the city is alive, can it remain unchanged, and can it be written as an iron plate? "

The narrator of My City is the character Aguo in the novel. When it was published in the newspaper, the author signed it with Aguo. Xixi once explained, "Aguo is actually my brother, because he graduated from middle school to find something to do at that time and ended up in a telephone company. He told me the stories he heard every day. I wrote this novel in the kitchen. "

In the book, she borrows the vision and language of young people represented by her younger brother Aguo to describe Hong Kong’s parks, Vietnamese refugee boats, water shortages and floods, social security and other issues at that time, as well as her personal life as a telephone line worker Aguo. According to the book, when Aguo received a phone call and learned that he was hired, he was extremely happy-

The telephone on the writing desk is camel-colored.

-I’m Aguo.

Who are you? Perhaps, you are Mr. Engineering Department, perhaps, you are Mr. Construction Department. I have no idea who you are. I told you I’m Aguo. Can you tell me who you are, too?

── A mother Xiu Xiu.

── You Mei Afa

What kind of relatives are there in your family? The picture of the little girl on the desk must be your daughter. She likes flying kites. I like flying kites. I have a tofu kite, but there is no place to put it.

-Just came out of school.

-It’s this year’s examination.

You’ve taken many exams, right? Do you also like geography and history when you are studying? Studying geography is interesting, and you can know that there is so much space. If you read history, you will know that time has no beginning or end. So much space, so no head and no tail time, but I will meet with you, only across a table, you say it’s a coincidence. But I don’t know who you are, and I don’t know if I can ask your name.

-was born in this city.

── Never left.

……

Yes, the weather is fine today. Later, you do what you like and I’ll do what I like.

The man sitting opposite the writing desk scribbled a string of words on a piece of paper and gave it to me.

-Young people, do it well.

He said.

-That goes without saying.

I said. I thanked him and came out.

Oh, the old sun shines on my head, the old sun in the eighteenth, fifteenth, twenty-seventh and thirty-ninth centuries. From tomorrow on, I can treat myself to dinner, I can treat my mother Xiu Xiu to dinner, and I can treat my sister Afa to dinner. I am very happy. I have been happy until the next morning.

-Xixi "My City"

My City/Xixi/Suye Publishing House/1979

The structure and text layout of My City are not solid, and it is not to bring readers to a definite ending. Xixi gives readers a free space to interpret, and everyone can have different interpretations.

Some people think that "My City" deliberately writes this novel in a childlike and almost childlike style. The text is relaxed and full of sunshine, but it also implies a satire on Hong Kong in the 1980s. Some critics also said that when reading the book My City, we might as well watch it from the perspective of the Riverside Scene at Qingming Festival, because the structure of My City is essentially the same as this picture.

Xixi herself said that she wrote My City with fantasy, which is different from magical realism in Latin America. Some people say it can be called fantasy realism, while Xixi says it may be called fairy tale realism. No matter what doctrine, it is always realistic.

1980s

Huang Biyun’s Love in the Prosperous Age

Dissect people’s hearts and look directly at life.

In the 1980s, Huang Biyun’s description of the living conditions of contemporary Hong Kong people showed a new trend.

Huang Biyun is a maverick writer. She has a master’s degree in criminology, worked as a journalist, an assistant to a member of parliament, opened a clothing store and studied modern dance. In her early years, she left the law firm as an intern in London and rented a small apartment in Spain. While writing, she studied flamenco diligently.

After returning to Hong Kong, Huang Biyun began to work in a busy law firm. However, her creation continued, and her life, like the city of Hong Kong, continued to fly like a dancer.

Writer and critic Nan Fangshuo commented on Huang Biyun: "She is different in narrative style and thought of her works. She hides redemption in decadence and is gentle in violence …"

Writer Yang Zhao said: "To read Huang Biyun’s novels, we must first understand what addiction is;" Reading Huang Biyun’s novels, let’s explore the significance of this felony of despair in our lives … "

Huang Biyun, like Zhang Ailing, is good at dissecting people’s hearts and looking straight at bloody life. Her "Love in a Prosperous Age" can be said to have won the true biography of Zhang Ailing.

Writer Huang Biyun

This novel, published in 1986, reveals a disease of the times and a disease of the city, and thoroughly exposes the alienated nature of modern marriage and the hopeless absurd relationship of modern people-respect each other as guests, but have no true feelings; Sleeping together, but having sex without love; Under the prosperous times, people are vain, helpless and lonely.

One of the core tasks of literature is to observe the world and people’s hearts, express the various forms of life, tell ever-changing stories, reveal subtle emotions and reveal the relationship between people and the surrounding world. Love in a Prosperous Age has such artistic characteristics, and it is a typical work in Hong Kong contemporary novels to express the relationship between the people of the city.

Cheng Shujing, the woman in the story, was originally a student of Fang Guochu. Later, they developed a teacher-student relationship and got married by lightning.

This marriage, which lacked true love, soon ended in divorce. The plot of the story is very simple, but the connotation is extremely profound, showing the chaos of war and the disillusionment of personal life value under the peaceful and prosperous times.

In the works, there are many scenes with expressive force behind the paper. For example, the scene where the teacher Fang Guochu proposed to the woman was at the scene of a car accident, and the two were touched by the scene-

Both of them had nothing to say in the car, and Fang Guochu reached out to hold Shujing’s hand. The book is quiet and struggling, and the country is lighter and more entangled. Book static then deigned, don’t look at him, but all feel his presence.

The book looked at the scenery outside the window quietly, a little confused. He loved her, but he was not influenced by her. He loves her, and he only regards her as a woman in a bed; He doesn’t love her, but he looks for her …

Shu Jing is just weak. At this time, the car suddenly braked, and the van in front collided with a taxi. Somehow, the tail of the van turned upside down, and it was quiet towards the book, and the front glass was broken. The driver is a young man in his twenties, lying on the steering wheel, asleep, with a few drops of blood sticking to his hair, and his color is very theatrical.

Fang Guochu pressed the number and said, "Shit, I don’t know how long it will take." Book static can’t help scratching at him. The young man struggled and fell down again, revealing the hand of the bones, which were extremely clean in the sun. The cars jammed were quiet, the police didn’t come, and everyone was calm, waiting around the bones, waiting for what.

Fang Guochu held the book tightly, and the book leaned against the window, which was cold and unpopular. She couldn’t help but breathe and let the window fog up to prove that she was alive. After a while, Fang Guochu said, "The Fire Department said that all ambulance personnel would arrive at the scene of the accident within 12 minutes, which is simply the biggest lie in the world."

Book static also can’t help looking at the bones. She thinks that nothing will go away before she has a bright nightmare, so don’t allow you to be arrogant. Fang Guochu suddenly said, "No, that’s just the third biggest lie."

How short life is, how rare it is to meet each other, how much you think about it, and how much you are obsessed with it. Before this bone, it was all a lie.

Fang Guochu said: "The second biggest lie is: I love you. I only love you. "

It doesn’t matter whether it’s empty talk or not. What’s not a dream in the mirror? Before the bones, perhaps the most stubborn person will be willing to be deceived.

Fang Guochu turned around, leaned against the steering wheel with one hand and said with a smile, "Do you want to hear the biggest lie in the world?"

Shu Jing always looked at the hand of Bai Gusen, and she didn’t care about anything when she put it on the steering wheel. Fang Guochu said, "Will you marry me?"

Shu Jing gently held his hand and felt blood and flesh-nothing more than flesh and blood. Maybe that’s it. Marriage. What does it matter? This body is nothing more than flesh and blood. She said, "Good."

She never turned to see him.

-Huang Biyun’s "Prosperous Love"

In this way, they got married. On the night of the bridal chamber, Fang Guochu was drunk, and Shu Jing said with a wry smile, "Marx said that marriage is institutionalized prostitution, so he was right." She found that she had done something wrong and "married an old man".

"falling sky" stills

Chu Yuan was a promising man who held high the ideal banner, but he became secular and lazy after marriage. "He got his doctorate, got the teaching staff, and the three-year probation period for doing research has passed … even got married." He became bored, and the only thing he could do was to get fat. He drank a big beer after class and completely ignored his wife’s feelings.

This kind of marriage is a portrayal of countless realistic husband-wife relationships in Hong Kong at that time-the same alienation and the same emptiness, but it seems that only Huang Biyun carved it so thoroughly and so thrilling.

In the history of Hong Kong literature, it seems that only Zhang Ailing has such talent and pen power. In fact, this work, like the modern version of Love in a Fallen City, has formed a wonderful echo.

1990s

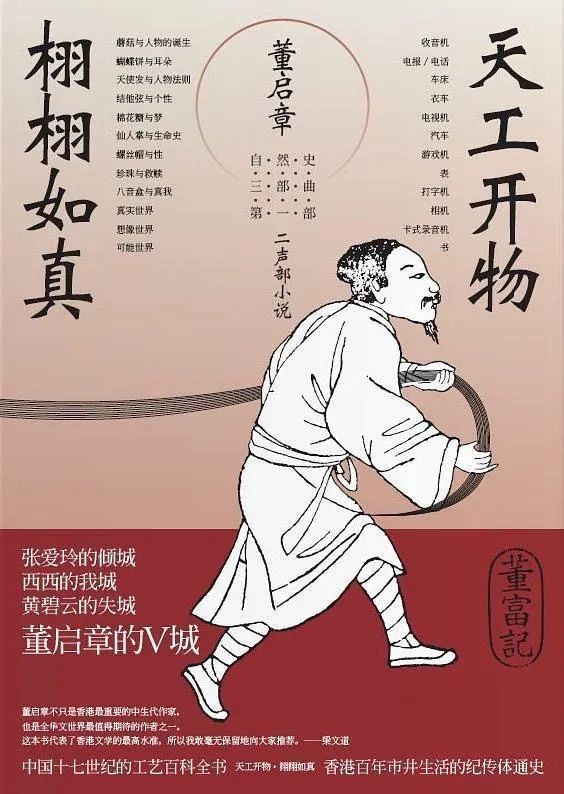

Dong Qizhang’s "Heavenly Creations, Realistic"

Literature is characterized by a word "slow"

Dong Qizhang is perhaps one of the most representative writers of pure literature in Hong Kong today.

In 1994, 27-year-old Dong Qizhang wrote the novella "Jenny Android" and the short story "Young Shennong". At that time, computers were not popular. He spent more than a month copying these two novels by himself and his friends, and sent them to Taiwan, China to participate in the "Joint Literary Novel Newcomer Award". In the anonymous judging, after several arguments, the judges selected Jenny Android as the first prize of novella and Young Shennong as the first prize of short story. They all agree that "Jenny Android" is a rare "female writing" and "negative writing". Yang Zhao, one of the judges, believes that although the author is from Hong Kong, the language level of the author of "Jenny Android" is obviously higher than that of "Young Shennong".

When the meeting ended, the organizer announced that the authors of these two novels were both Dong Qizhang, and the judges were very embarrassed. They had never heard of Dong Qizhang, not only that, but they didn’t expect that the authors were men.

Dong Qizhang was born in Hong Kong in 1967. He started writing in 1992 and worked as a middle school teacher. His life experience is not complicated. He studied all the way to the Bachelor of Arts and Master of Arts in Hong Kong University. It likes Proust, Calvino, Borges and other modern writers with dazzling knowledge, and gradually established its own literary view and writing style in such extensive reading, that is, literature should not only express feelings and aspirations, but also speak knowledge.

Dong Qizhang’s most important work is his trilogy of natural history. Among them, the first one, Heavenly Creations, Lifelike, has 500,000 words, and the trilogy has more than 1.6 million words in total.

Writer Dong Qizhang

This kind of personal epic novel, its writing perseverance itself is admirable, especially in Hong Kong, a city that pays attention to time and efficiency. A novel with nearly 500 pages is a miracle. Wang Dewei once commented that "I am willing to devote my life or half my life to the handicraft industry of literature and writing. We should pay tribute to Dong Qizhang and other writers like him. "

However, Dong Qizhang believes that the characteristic of literature is just a "slow" word. Everything is fast in the internet age, and it comes and goes quickly. "But literature should be written slowly, read slowly, feel and think slowly."

The trilogy of natural history is the product of Dong Qizhang’s precise planning and slow progress. From the beginning of his writing, he consciously built a common virtual world through many works, and they used the same names-V City, Dong Fu, Vivid and Xiaodong, which made people think of Faulkner’s "Yorknapatafa lineage" and the creative concept put forward in Canglang Poetry: the entry must be correct and the conception must be high.

This novel is first of all a personal history of Dong Qizhang or "I". In reality, Dong Qizhang’s business card is printed with "Dong Fuji Writing Workshop", which corresponds to the "Dong Fuji" mechanical parts manufacturing workshop once run by Dong Qizhang’s grandfather and father. He inherited the factory with literature. In this novel, his basic technique is to create the images that make up the story just like making parts, and then these image group weaves a complete symbolic system.

It is through one "thing" after another that Dong Qizhang described the history of Hong Kong for more than 100 years from the late Qing Dynasty to the early Republic of China to the reunification, told what happened in Hong Kong for more than 100 years, and described the stories of three generations of his family. Among them, there is not only a great history, but also a history of the relationship between objects and people.

For example, one of the items is an old sewing machine. For many families in Hong Kong, the old sewing machine is worth remembering, because when Hong Kong’s economy was about to take off, many women were driving such an old sewing machine at home to help with the work of material processing, earning some extra money and supplementing their families.

This book has a very subtle description of the old sewing machine, which is said to be more violent than all heavy machines. It poked the dolls needle by needle and pierced them to connect them-

Vivid, I must tell you honestly, your image sprouted earlier than when I met Ruzhen. This idea was born in my childhood when I helped domestic workers. No, it’s not just an idea, it’s a concrete prototype of you.

It was a time when my mother picked up dolls to make artifacts. At first, it was just sewing women’s shirts and skirts as small as an adult’s palm, including mini skirts, student skirts, tennis skirts, denim skirts and sexy evening dresses with suspenders, as well as a swimsuit with lace on the hips and a puzzling bikini.

When I was sitting next to the locomotive-like clothes cart and cutting threads for these small clothes one by one, I seemed to feel the hint of these intimate clothes. At a young age, I don’t think of the clothes popular with young girls on the street.

They just remind me of a person’s closet. That wardrobe is full of clothes of that color, line and pattern. Sometimes they are attached to a body, and sometimes they are removed.

Later, we didn’t just sew dresses, but my mother brought back two bags of light pink things, one of which was filled with a small soft pillow-shaped flat baby face. The cold blond hair on the head and face, beaded eyes, ears protruding on both sides, a soft button nose and a curved mouth embroidered with red lines have also been made by other workers. The other bag contains cloth pieces of different sizes and shapes, which are stitched together to form the hands, feet and torso.

In fact, the process is not difficult, as long as those limb pieces are stitched on top of each other, with the reverse side outside and the front side inside, and connected into a flat human figure, leaving an opening at the lower part of the body, pulling out the material that should have been the front side from the opening, like turning over gloves, and then stuffing cotton with bamboo chopsticks from the opening until it is filled into a three-dimensional pink limb. Then sew up the head, then sew up the hole in the lower body, and finally put on a pre-made blouse and skirt, and you’re done.

Of course, the lathe work is all done by my mother alone. I am responsible for stuffing cotton from my lower body and the final dressing steps.

Sometimes the cotton is blocked at the joint, so I poke it into the hole with chopsticks, and I don’t feel rude. I’m afraid to see the sewing needle of the clothes cart plunge into those soft humanoid materials, as if the meridians all over my body were swollen and painful at the same time. But I can’t help but watch the process, especially the final process. That’s to be stitched by hand. The needle tip goes into one side of the breach, and the eye of the needle pulls the thread in, stirring up the flesh on the other side, piercing, pulling it out, and going back to the other side, like learning to wear a shoe belt when I was a child, until the whole lower body is tightly closed. A few years later, I witnessed the traces left by such a procedure on my aunt He Yayu’s belly.

-Dong Qizhang’s "Heavenly Creations, Realistic"

Heavenly Creations, Lifelike/Dong Qizhang/Shanghai People’s Publishing House/March 2010

This novel is full of different objects, which are written as metaphors and symbols, representing the changes of the whole history.

What Dong Qizhang wants to emphasize is that all the characters in the novels are actually "things" because they are named after Song Yingxing in the Ming Dynasty. "Heavenly Creations" is just a process of artistic creation, and there is no distance between natural creations and man-made ones.

Liang Wendao recommended Heavenly Creations: "It’s a novelist’s novel. It almost wants to exhaust all the novel skills you can imagine. "

2000s—2020s

Ma Jiahui’s "Dragon Head and Phoenix Tail"

Just do what you are happy about.

Ma Jiahui was born in 1963, and his father was the editor-in-chief of a newspaper. He bathed in cultural atmosphere since childhood, but he did not have a typical literati character, but he was somewhat Jianghu.

Ma Jiahui’s growing years are just catching up with the rapid development of Hong Kong in the 1970s. Wan Chai, where he lived, was also one of the most chaotic, street-like and dynamic places in Hong Kong at that time. Sometimes, he sits in a food stall and eats breakfast, and behind him is the underworld who fights and kills.

At the age of 20, Ma Jiahui had already been admitted to a university in Hong Kong, but because he was fascinated by Li Ao, he went to Taiwan Province to study while doing Li Ao studies.

When he was a sophomore or a junior in college, his book "Destroy Li Ao or Be Destroyed by Li Ao" became a best seller in Taiwan Province. Even Li Ao himself said to him, "Jiahui, Hu Shi said that I knew Hu Shi better than Hu Shi. I said today that you know Li Ao better than Li Ao. "

At the age of 30, Ma Jiahui got a doctorate from the University of Wisconsin, but he didn’t have the patience to be a scholar. He returned to Hong Kong and became a vice president of Ming Pao, making a big turn before he came to teach at the university.

Writer Ma Jiahui

Ma Jiahui writes a column for a newspaper, goes to a TV station to do a program and be a guest. It seems that he can pick up any martial arts. But when he was almost 50 years old, he suddenly sat down and wanted to write a novel, not one, but a "Hong Kong trilogy".

"Writing novels is an eternal challenge for a person who loves literature and writing." Ma Jiahui said, "Maybe I’m pessimistic. I feel that once I’m over 50, what I see is different from what I saw before. Before I was fifty, I looked ahead and thought I had a lot to do. After 50, my eyes look back, as if I feel that there is not much time ahead. "

The first part of the "trilogy" is called "Leading Phoenix Tail", which was published in 2016 and wrote about Hong Kong during the Japanese occupation; The second book, Yuanyang 674, was written in Hong Kong in the 1950s and 1960s and published in 2020. The third part, which Ma Jiahui wants to write, is about Hong Kong in the 1970s and 1980s, until the return of Hong Kong.

Feng Wei, the Dragon Head, is an ambiguous story between Lu Nancai, a triad boss who fled from Guangzhou to Hong Kong, and Zhang Dichen, a British policeman.

In order to avoid chaos, Lu Beicai fled to Hong Kong from his hometown of Heshi Town, Maoming City, Guangdong Province. His name changed from north to south, and he settled in Wan Chai as a rickshaw puller, shuttling between bars, police stations, casinos and prostitutes’ villages in Wan Chai and Central Sheung Wan.

Behind the history of the rise of gangsters, there are the colonial regime in the 1930 s and 1940 s, the Japanese invasion of China and the fall of Hong Kong. The novel also involves Chen Jitang, Du Yuesheng, Wang Jingwei and other historical figures.

In such troubled times, in the complicated bottom society, Ma Jiahui wanted to write about the homosexual love between Chinese and foreigners, and used gender to intensify the conflict and struggle between race and power in the story.

Ma Jiahui once said, "In the sixties when I was growing up, foreigners were really powerful, with a big head and a lot of chest hair, so I was surprised to see them in detail;" Office toilets are separated by white Chinese, which is a social reality. "

This distinction between China and foreign countries also makes this love more valuable and shocking.

Liu nancai, the protagonist of the story, thought about Zhang Dichen day and night, so he carved the word "God" on his arm and regarded me as a god. However, in the end, he did not wait for a perfect result-

When he was in a hurry, Liu Nacai occasionally remembered Zhang Dichen. What is he doing? Must be equally busy. Every time Liu Nacai reads him, he touches the word "God" on his right arm. My minister, my God, sees words like people. Once the war starts, he will go to war? Can you survive it? Liu Nacai is worried, but he is not desperate. He believes that with Zhang Dichen’s wit, even if the situation is chaotic, even if he is trapped in the worst situation, there is still a way to dig a tunnel for himself, and at least he can escape.

……

"On the way, I suddenly changed to a tattoo shop, stretched out my right arm, pointed to the word" God "and asked," Master Hong, is there any way to get rid of it? "

Master Hong shook his head and said, "Nanye, I’m sorry,no."

"No have to have! I don’t want to see this word again! " Liu Nacai stare nu way.

Master Hong didn’t expect Liu Nancai to suddenly get angry, so he stepped back in fear and said in a trembling voice, "Maybe … Master Nan, if you want to keep it, but don’t want to see it only, you can actually add some words before and after, for example, adding’ big’ in front of it to become a’ great god’; Or add a’ Ming’ after it and become a’ god’. This is a workaround. "

Liu Nacai frowned, hesitated, and couldn’t make up his mind for a moment. Master Hong reminded him to think about it slowly, and then turned to the kitchen to boil water and make tea. Lu Nancai stopped Master Hong and said, "Add more words, add more words." -When Lu Nancai left the third floor of Master Hong’s Tang Dynasty, the word "God" on his right arm became seven words: Hold your head three feet high and have a god.

Liu nancai’s god is still on his skin.

-Ma Jiahui’s "Leading Phoenix Tail"

Some media asked Ma Jiahui about the "Hong Kong Trilogy", but your last love letter to Hong Kong.

Ma Jiahui, who was originally sloppy, was noncommittal. "I just want to do what I am happy about."

The light of the future

After the return of Hong Kong, the young writers of the "post-1997" generation continued the urban writing of their predecessors and continued to create their own cities and legends.

For example, Keluo and Han Lizhu have published ten or more collections of short stories and novels. Other writers, such as Chen Zhihua, Xie Xiaohong, Li Weiyi and Zhang Wanwen, are also publishing their own works.

After decades of urban development, capital has shaped Hong Kong into a city with the largest number of skyscrapers (1,309) and the highest density of shopping malls in the world. Urban space is constantly encroaching on natural space, which has become a lingering haze for young writers in Hong Kong after 1997 to write about urban experience.

For example, Keluo’s City of Whales and Chen Zhihua’s "City of O" are called the continuation of Xixi’s My City, but they are brand-new versions of the times. Like their predecessors, they have given Hong Kong a new "flower name" and "nickname" and are also looking for a new way to speak for the city.

References:

Liu Yichang’s "Down"

Xixi’s My City

Zhang Ailing’s Love in the Whole City

Jin Yong’s Legend of the Condor Heroes

Dong Qizhang’s "Heavenly Creations, Realistic"

Huang Biyun’s Love in the Prosperous Age

Chen Pingyuan’s Hong Kong: Urban Imagination and Cultural Memory

Liang Wendao’s I Read.

Liao Weitang’s Bohemian Hongkong

Wang Dewei’s Trees on the Cliff

Rover’s "I miss my old friend in the season of flowers"

The History of Hong Kong, China Literature edited by Li Munan, Zhi Zhiyi and Liu Jinling.

Chen Zishan’s Collection at a Glance: Random Talks on Hong Kong and Macao Literature

Zhao Xifang: The "First Shout" of Hong Kong Literature

http://news.takungpao.com/paper/q/2017/1118/3516206.html

On Jin Yong’s Novels and the Regional Love in Hong Kong

https://m.fx361.com/news/2021/1130/9154879.html

Pu Shi’s Jin Yong in Hong Kong, Jin Yong’s World

https://www.bluewindweekly.com/

Liu Yichang and Hongkong Literature

https://www.sohu.com/a/155159576_748568

Xixi: She Makes Literature the Pride of Hong Kong

http://style.sina.com.cn/cul/books/2011-07-30/001381692.shtml

Strange girl Xixi in Hong Kong Literature World

https://xw.qq.com/amphtml/CUL2016031602284200

Huang Biyun’s New Work "Blood Carmen" on Dance and Life

http://www.chinawriter.com.cn/2002/2002-01-14/9321.html

Dong Qizhang: I want to write an epochal loneliness.

https://www.jiemian.com/article/284132.html

Zou Wenlv: City and Nature in the Novels of Young Hong Kong Writers after 1997