Director:

Screenwriter: Christopher Nolan/

Starring:/carrie-anne moss//Rush Figa … …

Type: plot/suspense/thriller/crime

Producer country/region: USA

Language: English

Release date: October 20, 2000

Length: 113 minutes

Special feature of 1905 film network It is a suspense film directed by Christopher Nolan and co-starred by guy pearce and carrie-anne moss.This film tells the story of Lenny, who suffers from anterograde amnesia, searching for the killer of his wife through fragmented memory.

# The Time Traveler who Constructs the Narrative Labyrinth #

When you mention Nolan, which movie comes to mind first? Did you really blow up a plane in the movie?

Or in the movie, Nolan and the staff specially planted a cornfield?

Or would you rather use paper instead of real people than shoot with special effects?

In fact, Nolan is a veritable "time magician" besides being a "real-shot maniac" who doesn’t like to use special effects in movies.

Memento’s opening flashback movie clip

This director, who majored in English literature in college, started from his first novel "Follow", and firmly branded the film style of "nonlinear narrative" in each of his works, breaking the narrative rules and deconstructing the context of time. Nolan’s works are the repeated expansion and deepening of the concept of time.

"Follow" movie poster

Nolan’s film career began when he was very young. When he was 7 years old, he began to make a preliminary film with his father’s small camera. Perhaps he got a lot of fun from filming. Nolan said that he made up his mind to make a film in the future when he was 10 years old. When he went to college, he founded the "16mm" club in partnership with his friends.

Christopher Nolan in his youth

He studied how to make a movie with a group of like-minded friends, and the novel Follow was born here. This work, which was completed at a cost of $6,000, attracted Nolan a lot of attention. Although the budget of the second work, Memento, rose directly to $4 million, it fell into a dilemma that no one was willing to release after the filming.

Nolan and Memento starred in guy pearce

As the saying goes, a hero has three gangs. The protagonist in Memento relies on photos and words to help him find clues, and Nolan, the director outside the play, also has his own right-hand man. It is also because of their help that Memento was able to meet the audience smoothly after several setbacks.

# Best creative partner #

Memento’s story blueprint is derived from a short story by his own brother, jonathan nolan.

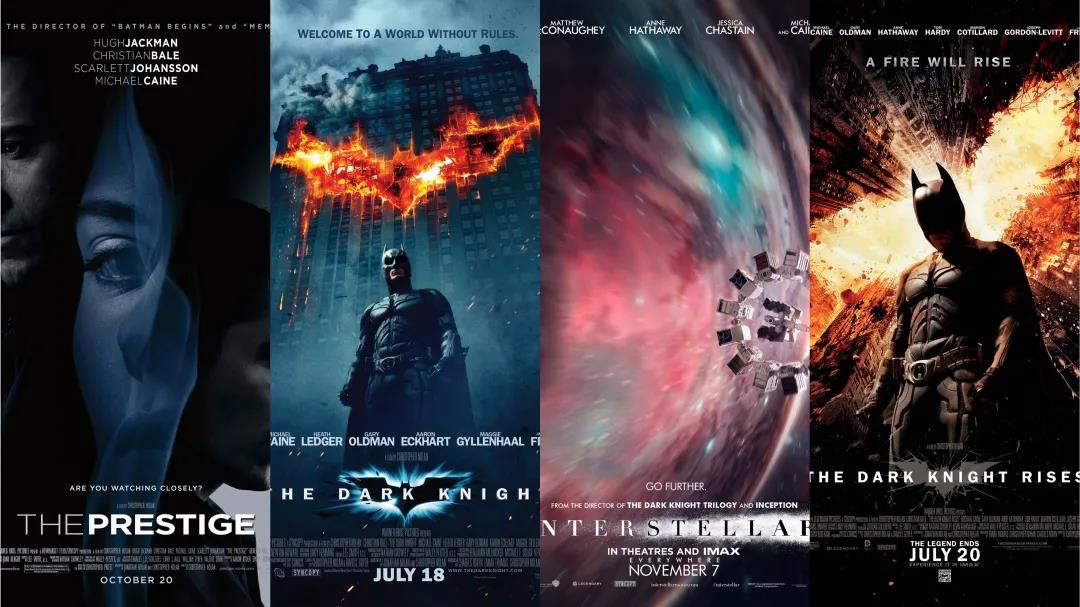

Since Memento, Jonathan, as a screenwriter and Nolan’s partner, has successively completed five films, including,, Interstellar, etc.

But just as Nolan is left-handed and his brother is right-handed, it is inevitable that there will be differences between the two brothers in creation. For example, in the previous box office word-of-mouth harvest, the two brothers had conflicting opinions.

Nolan and his younger brother jonathan nolan.

Inception is Nolan’s first independent screenplay. He just started to write a typical Hollywood theft film. The biggest villain in it was originally designed by Joseph, who told a story about a friend’s betrayal.

Inception movie poster

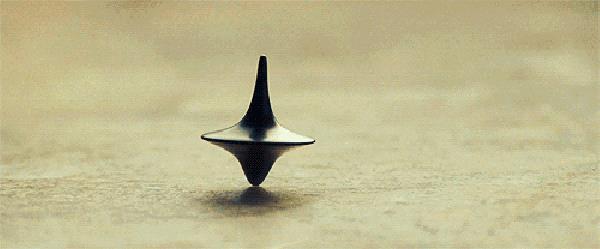

As a result, his brother said after listening, this is too vulgar. Why do you want to make such a film? Then Nolan began to change, and this change was ten years. After filming, he showed it to his brother as soon as possible, and he also wanted to say whether to delete the last gyro spinning scene in the film.

Inception gyro fragment

The idea was stopped by Jonathan, who thought it was interesting to let the audience challenge the process itself. Of course, it turns out that the audience is much smarter than they thought. Nolan thinks that their differences in creativity all stem from sincerity, which is not difficult to solve. So Memento, as their first film collaboration, the two brothers were nominated for the American Academy Award for Best Original Screenplay.

Memento movie stills

# Closest partner and confidant #

Memento, a film with a production cost of $4 million, earned $25 million at the box office in the United States.

Memento movie stills

Memento movie stills

This data can be said to have dumped the mainstream American market in 2000 with a loud slap in the face. Why do you say this? Because almost no distribution company in the whole United States is willing to take over after the film has just been produced, even if the film has won praises at many international film festivals such as Venice and Toronto, and more than 20 foreign distributors are willing to join, because they think the film itself is too chaotic to attract a large audience.

Memento movie clips

Finally, the production company of the film, a private film company called New Market, took financial risks and undertook the release of the film. And the key figure is Nolan’s closest confidant, his wife.

Nolan and his wife emma thomas.

Speaking of Nolan’s relationship with Emma, I really envy others. The two met on the first day of college, lived in the same dormitory building, and later Nolan joined the school’s film club with Emma. He studies technology and Emma runs it. In Nolan’s words, although Emma’s work is not glamorous or eye-catching, she participated in every link of his later film production and was his closest friend.

Memento movie stills

Memento movie stills

After graduation, Emma entered the New Market Film Company, became one of the producers in Memento, and became the first audience of Nolan’s works.

Memento movie clips

With the help of his brother and wife, this Memento, which condensed Nolan’s painstaking efforts, made it onto the big screen smoothly, and won a domestic box office of $25 million. This week, let’s go into the movie Memento and see this maze of time built by Nolan 21 years ago.

This week’s show live

This week’s show live

Welcome to CCTV6 "Junlebao"

June 19th (Saturday)

Saturday Promotion Edition 22:15

Memento 22:24

20 June (Sunday)

Memento 13:28

Sunday Film Review Edition 15:23