N Our reporter Liao Qingsheng Gao Minwen/map [Citizen’s Response] Yesterday morning, Mr. Zhuang called our newspaper 968111 to report that parking is free in Rongcheng Square, Jinshan, Fuzhou, and no tickets will be posted. Many people who work nearby parked their cars, and some cars that came in late stopped directly on the blind road, hoping that the relevant departments could guide them. [Check immediately] Yesterday morning, the reporter saw at the scene that there were two rows of cars parked on the passage in the square, and the aisle next to the flower garden was a blind road, but they were all full of cars. The reporter noticed that there were many "Do not occupy the blind road" signs hanging in the parking place, but the warning signs did not stop the car owners from occupying the blind road. [Reporter’s connection] The staff of the Plaza Property Office said that some of these cars are merchants, and many of them are parked. Because the property can’t judge whether the owners come in for shopping, they can only be released. For the behavior of occupying the blind road, the property office has repeatedly discouraged it and installed warning signs, but some car owners still ignore it. "The property has no law enforcement power. In addition to strengthening dissuasion, we will also try to negotiate with the police to see if there are better management methods." The staff said. Thank Mr. Zhuang for providing clues and rewarding 30 yuan.

分类: bb

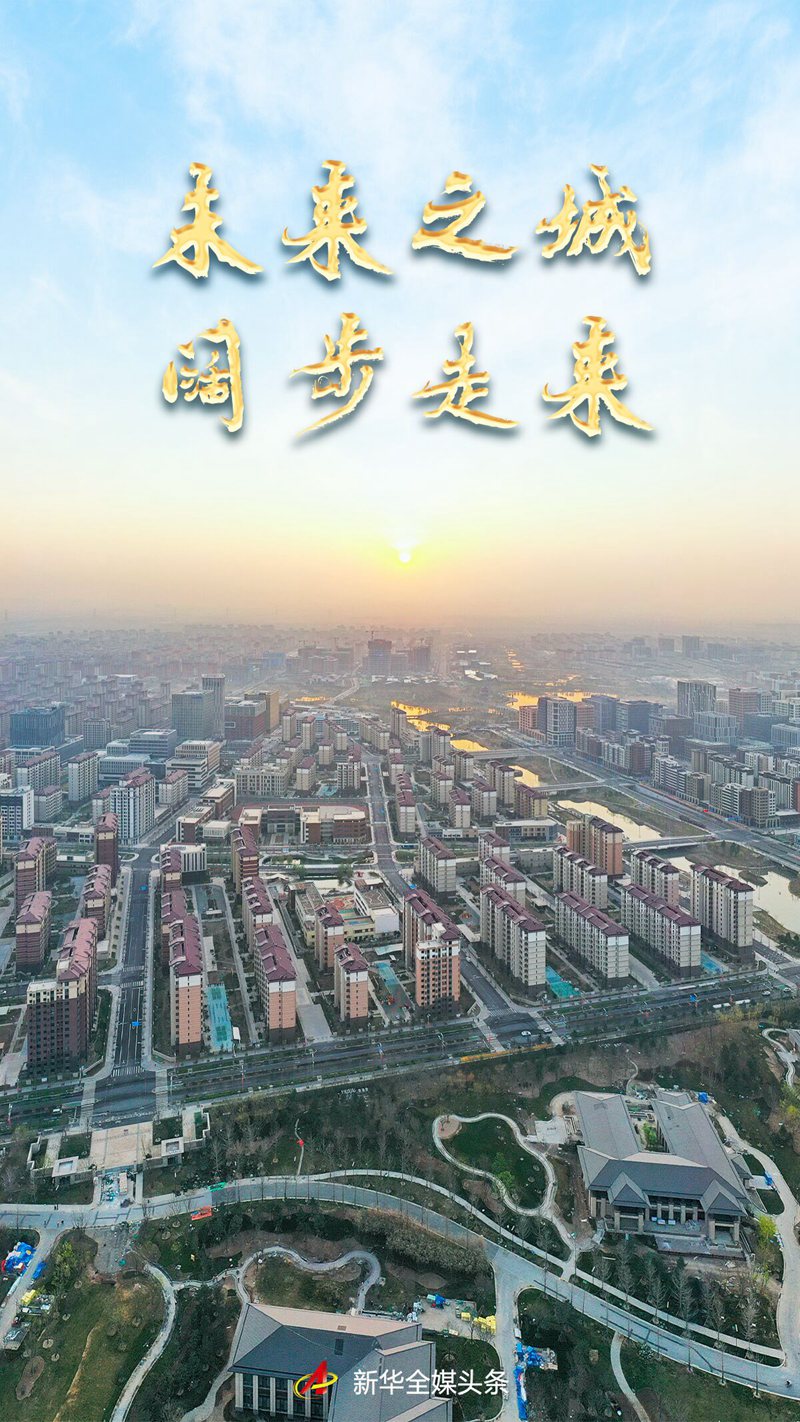

The City of the Future Strides Forward —— A Review of the Sixth Anniversary of Building xiong’an new area with High Standards and High Quality

Xinhua News Agency, Beijing, April 1st Title: The city of the future is striding forward — — Review on the Sixth Anniversary of Building xiong’an new area with High Standards and High Quality

Xinhua News Agency reporters Li Fengshuang, An Bei, Yan Fujing and Zhang Tao.

In the warm spring of April, Beijing is more than 100 kilometers to the south, Baiyangdian is rippling, and full of green is a "Millennium Xiulin", and the construction of the start-up area is in full swing … … The embryonic form of a modern new city appeared.

On April 1st, 2017, Xinhua News Agency was authorized to announce that the Central Committee of the Communist Party of China and the State Council decided to set up xiong’an new area.

This is Xiong ‘anmen, xiong’an new area (photo taken on March 15th, 2023). Xinhua News Agency reporter Zhu Xudong photo

The establishment of xiong’an new area in Hebei Province is a major decision made by the CPC Central Committee with the Supreme Leader as the core to further promote the coordinated development of Beijing, Tianjin and Hebei, and it is a Millennium plan and a national event. General Secretary of the Supreme Leader personally made decisions, personally deployed and personally promoted, and devoted a lot of efforts to guide the planning and construction of xiong’an new area.

In 6 years, more than 2,000 days and nights, xiong’an new area is a city of the future with high starting point planning, high standard construction and high quality development. It has broken ground, sprouted and grown, and strode towards us.

High standards, new ideas — — Relieve Beijing’s non-capital function and build a benchmark city

At 6: 56 in the morning, the reporter’s Fuxing high-speed train departed from Beijing West Railway Station on time, all the way south, stopped at Beijing Daxing International Airport, and arrived at Xiong ‘an Station in Zangang Town, Xiongxian County, xiong’an new area after more than 50 minutes.

A high-speed train leaves Xiong ‘an Station of Jingxiong Intercity Railway for Beijing (photo taken on March 22, 2023). Xinhua News Agency reporter Yan Yushe

Today, there are 14 pairs of intercity trains between Beijing and Xiong ‘an every day. With the acceleration of the construction of the external backbone transportation network, the ancient capital of the Millennium and the city of the future are increasingly closely linked and integrated.

About 30 kilometers to the west of Xiong ‘an Station, tower cranes stand in the core area of xiong’an new area Start-up Zone, and builders sweat on this hot land, constantly refreshing "China Quality" and "China Speed".

On the new journey of building a socialist modern country in an all-round way, xiong’an new area, as an important wing of Beijing’s development, is accelerating the rise of Beijing-Tianjin-Hebei, an important pole of high-quality development in China.

Time goes back to more than six years ago.

On the morning of February 23, 2017, General Secretary of the Supreme Leader made a special trip to Anxin County, Hebei Province to inspect the general situation of the core area of the planned new district. In Xiaowangying Village, Dawang Town, the general secretary walked into an open field and looked far away. This is the core plot of the planned xiong’an new area starting area.

At noon that day, a small symposium was held in Anxin County. General Secretary of the Supreme Leader emphasized that the planning and construction of xiong’an new area is a strategic choice of great historical significance and a historic project to relieve Beijing’s non-capital function and promote the coordinated development of Beijing, Tianjin and Hebei.

Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has deployed a major strategy to promote the coordinated development of Beijing, Tianjin and Hebei. The core is to explore a mode of optimal development of densely populated areas and find a way to solve the "big city disease" with China characteristics.

The planning and construction of xiong’an new area is the key to further promote the implementation of the grand strategy of coordinated development of Beijing, Tianjin and Hebei, and to build a centralized bearing place for Beijing’s non-capital functions.

In xiong’an new area Planning Exhibition Center, the "1+4+N" planning system on the exhibition board attracts visitors’ attention.

On January 16, 2019, General Secretary of the Supreme Leader came here to listen carefully to the introduction of the overall planning, policy system and construction of the new district. The general secretary stressed that the new district should first be forward-looking and leading in the concept of planning and construction. We must fully implement the new development concept, adhere to the requirements of high-quality development, and strive to create a benchmark for high-quality development in the new era.

Millennium plans must stand the test of history and reflect the style of the times.

This is the Baiyangdian Tourist Terminal in xiong’an new area (photo of drone on September 7, 2022). Xinhua News Agency reporter Yang Shizhen photo

Since the establishment of xiong’an new area, we have insisted on "planning every inch of land clearly before starting construction, and don’t leave historical regrets". More than 60 academicians, more than 200 teams at home and abroad, and more than 3,500 experts and technicians have participated in the preparation of the new district planning system; Guided by the Planning Outline of xiong’an new area, Hebei Province, four basic plans and more than 20 special plans have been formed, namely, the overall planning of xiong’an new area, the regulatory planning of the starting area, the regulatory detailed planning of the starting area, and the ecological environment control and protection planning of Baiyangdian Lake.

After "planning", xiong’an new area’s construction and development have been accelerated in an all-round way. In 2019, a major shift from planning to construction will be realized; In 2020, it will enter a new stage of large-scale construction; In 2021, it will enter an important stage of undertaking Beijing’s non-capital function and simultaneous construction … … A blueprint is drawn to the end, and a beautiful picture of high-quality development is slowly unfolding.

It is the initial intention to set up xiong’an new area to build a centralized bearing place for relieving Beijing’s non-capital functions.

This is the project site of Xiong ‘an Sports Center located in the start-up area of xiong’an new area (photo taken on March 15th, 2023, drone photo). Xinhua News Agency reporter Zhu Xudong photo

At the beginning of the establishment of the new district, General Secretary of the Supreme Leader emphasized: xiong’an new area is different from the new district in the general sense, and its orientation is firstly to relieve Beijing of its non-capital functional centralized bearing place, focusing on undertaking administrative institutions, headquarters enterprises, financial institutions, universities and research institutes, etc., which do not meet the requirements.

In accordance with the decision-making arrangements of the CPC Central Committee and the State Council, starting from 2021, we will focus on universities, hospitals and headquarters of central enterprises affiliated to ministries and commissions in Beijing, and promote relevant non-capital functions to xiong’an new area in stages and batches.

In the enterprise headquarters area of the start-up area, the reporter saw that the construction of China Sinochem headquarters base has entered the construction of the main structure above the ground, with dozens of steel structure columns erected high and octagonal shapes beginning to appear. This building with the design concept of "Golden Reed" in Baiyangdian symbolizes endless growth.

Xiong’ an Campus of Beijing No.4 Middle School and Xiong’ an Campus of Shijia Hutong Primary School (photo taken on March 26th, 2023, drone photo). Xinhua News Agency reporter Yang Shizhen photo

Not far away, as the first central enterprise registered and settled in xiong’an new area, the main structure of the xiong’an new area headquarters building project of China Satellite Network Group Co., Ltd. entered the secondary structure construction stage and is scheduled to be completed by the end of this year; China Huaneng headquarters has been accelerated, and China Mineral Resources Group has determined the location. A few kilometers away, the projects of Beihai Kindergarten Xiong ‘an Campus, Shijia Hutong Primary School Xiong ‘an Campus and Beijing No.4 Middle School Xiong ‘an Campus have been delivered, the first phase of Xiong ‘an xuanwu hospital Project has basically ended, and Xiong ‘an Sports Center and University Park Library have sprung up … …

This is the Xiong ‘an xuanwu hospital project located in the start-up area of xiong’an new area (photo taken on March 15th, 2023, photo of UAV). Xinhua News Agency reporter Zhu Xudong photo

Up to now, central enterprises have set up more than 140 institutions in xiong’an new area, including more than 90 secondary and tertiary subsidiaries, and more than 3,000 registered enterprises in Beijing have invested in the new district.

In order to speed up the implementation of the project, xiong’an new area has set up three special classes to undertake corporate headquarters, universities and hospitals, and adopted the service working mechanism of "one project, one team, one scheme and one follow-through".

Li Bo, deputy commander of the headquarters of xiong’an new area Start-up Area, said that the headquarters set up a project promotion team to "move" the work station to the construction site, ask about the difficulties encountered in the process of enterprise construction on the spot, solve small problems on the spot, and immediately organize relevant departments to coordinate and deal with cases that are not easy to handle.

Starting with a pen is the vision of the world, and setting pen to paper is the benchmark of the times.

In today’s xiong’an new area, the embryonic form of the city has emerged: the spatial pattern of urban and rural areas is clear and clear, the design of urban and architectural features is steadily advanced, the "four systems" of urban peripheral road framework, internal backbone road network, ecological corridor and new district water system run through the whole region, the urban functions are constantly improved, and the urban framework is fully opened.

Speed up the formation of underground city: Spider-web cables have disappeared, and supporting facilities such as electricity, communication, heat, gas and water supply have all been installed in the 47.6-kilometer underground pipe gallery that has been completed and put into operation in advance. More than 20 kinds and nearly 10,000 sets of front-end sensing devices are laid in the underground pipe gallery to realize full coverage of video surveillance.

"Xiong ‘an on the Cloud" was initially completed: for the first time in the history of urban construction in China, the simultaneous construction of digital cities and real cities was realized in the whole region. Every building and street lamp in real cities corresponds to each other in digital cities.

At the end of 2022, Xiong ‘an City Computing Center, as the "urban brain", was officially put into operation, providing network, computing and storage services for big data, blockchain and Internet of Things in digital twin cities, creating a smart scene.

With world vision, international standards, China characteristics and high-point positioning, xiong’an new area is blooming with great vitality.

High level, new home — — Adhere to the people as the center and build a livable city.

This is the Rongxi area in xiong’an new area (photo taken on August 25th, 2022, photo of drone). Xinhua News Agency reporter Zhu Xudong photo

More than ten kilometers to the north from the corporate headquarters in the start-up area, on Nanyuan South Square in xiong’an new area Yuerong Park, a photo art exhibition called "Seeing Xiong ‘an" recorded the butterfly changes in the new area.

One photo after another frames the reeds in Baiyangdian Lake, playful children and modern city features. Outside the photo, the people who stopped to watch the new district, the ecological landscape corridor in full of green, and the resettlement houses with both traditional and modern architectural styles and designs form a harmonious picture of people, scenery and city.

Streets and parks in the Rongxi area of xiong’an new area (photo taken on March 31, 2023, photo of drone). Xinhua News Agency reporter Yan Yushe

At the beginning of the planning of the new district, the General Secretary of the Supreme Leader pointed out the direction for the construction of the city: "We must persist in taking the people as the center and proceed from the needs of the citizens, so as to achieve density, green and low carbon, return to the original, provide a livable environment and high-quality public services, and effectively attract the population and functions of Beijing."

In the past six years, the background color of the people painted on this white paper has become more and more intense.

In spring, Baiyangdian Lake is dotted with more than 140 lakes. On the misty water, various birds such as spotted ducks and mallard ducks are living and foraging.

According to Jia Guoyong, Deputy Secretary-General of xiong’an new area Xiongxian Bird Protection Association and Bird Inspector of Xiongxian Forestry Center, the increase of birds is a direct manifestation of ecological improvement in this water area.

"The emergence of new bird species in such groups was rare before, and the environment in Baiyangdian is indeed getting better." At the end of last year, a large group of baikal teal photographed by Jia Guoyong was recognized as one of the new bird species in Baiyangdian.

Adhere to ecological priority and green development, and build a new area integrating green, forest, wisdom and water city. According to the Planning Outline of xiong’an new area, the future Xiong ‘an will be embedded in the ecological space interwoven with blue and green, and the proportion of blue and green space will be stable at 70%.

Baiyangdian Lake has experienced the largest systematic ecological management in history, and the water quality has been upgraded from inferior V to III, with 252 species of wild birds, 46 more than before the establishment of the new area, and the function of Baiyangdian Lake as the "kidney of North China" has initially recovered;

More than 470,000 mu of "Millennium Xiulin" has been spread in an orderly manner, and more than 280 species and more than 23 million seedlings have thrived in the new area. The forest coverage rate has increased to 34%, and PM2.5 has decreased by 37% compared with that before the establishment of the new area & hellip; …

In the past six years, the ecological pattern of full of green and Shuicheng has gradually taken shape, and the ecological spatial pattern of "one lake, three belts, nine pieces and many corridors" has taken shape. The scenery and life of an idyllic city with 300 meters into the park, 1 kilometer into the forest belt and 3 kilometers into the forest are becoming a reality.

A safe and convenient three-level road system, the landscape environment of pushing the window to see the green and opening the door to enter the park, not pursuing super-high buildings, emphasizing the balance between occupation and residence & HELIP; … At present, 1,500 residential buildings have been put into use in Xiong ‘an key residential area, nearly 120,000 people have moved to new homes, supporting facilities such as schools, hospitals, supermarkets, parks and pension stations have been gradually improved, and the "15-minute living circle" has been accelerated.

According to the latest report of Xiong ‘an Green Research Think Tank, xiong’an new area people’s evaluation and satisfaction with the public services in the new district have improved significantly. As a city of people, the level and quality of public services not only affect the happiness of the people in the new district, but also determine the bearing capacity and attractiveness of the new district.

The water system in Rongdong area of xiong’an new area is bathed in the morning light (photo taken on March 31, 2023, photo of drone). Xinhua News Agency reporter Yan Yushe

Walking into Xiong ‘an Rongdong Branch of Beijing No.80 Middle School, located in Rongdong ‘an District, the standard playground of the 400-meter track is clean and tidy, with geography classrooms, history classrooms, math classrooms and psychological consultation rooms … …

Students from Yunxi Primary School in Rongxi District, xiong’an new area do exercises on the playground (photo taken on March 23rd, 2023). Xinhua News Agency reporter Yan Yushe

2023 is the fifth year that Hu Youyong, president of Xiong ‘an Rongdong Branch of Beijing No.80 Middle School, aided Xiong ‘an Education. "In the past five years, I have deeply felt the continuous development of Xiong ‘an education and the power of reform and innovation. It’s not easy for Xiong ‘an people to enjoy a high-quality education at their doorstep, but it’s also true for me ‘ Temptation ’ 。” The educator who is in his sixties said.

The staff worked in the monitoring room of underground pipe gallery in Xiong ‘an Rongdong (photo taken on March 30, 2023). Xinhua News Agency reporter Zhu Xudong photo

Wang Ruizhi, head of the Education Group of xiong’an new area Public Service Bureau, said that since the establishment of the new district, there have been 29 schools in Rongdong, Rongxi and Xiongdong districts, and nearly 20,000 children of the relocated people have enjoyed better education. "Education is a key factor in determining the future development of xiong’an new area. While upgrading hardware, it is a top priority to continuously improve the level of education. " He said.

"People come to Xiong ‘an for a better life besides work. In the second half of China’s urbanization, more attention was paid to ordinary people’s yearning for a better life, and Xiong’ an had to look for various possibilities. " Li Xiaojiang, an expert from the Beijing-Tianjin-Hebei Collaborative Development Expert Advisory Committee, said.

This is the Millennium Xiulin in xiong’an new area (photo taken on September 6, 2022, photo of drone). Xinhua news agency

"The water town of Huaxian County is now Xinyi, and the ancient city of Jiangnan in the north." Xiong’an new area, a land with a long history of thousands of years and a glorious revolutionary tradition, is exploring a new era model of a modern livable and suitable city.

High quality, new mechanism — — Persist in reform and opening up and build a city of innovation

The construction and development of a new city must respect the laws of urban development and construction. At the beginning of the establishment of xiong’an new area, General Secretary of the Supreme Leader emphasized that the construction of xiong’an new area is a historic project, and we must maintain historical patience and have the spiritual realm of "I don’t have to be successful".

Entering the stage of undertaking Beijing’s function as a non-capital city and simultaneously advancing its construction, all the key tasks of xiong’an new area are rolling stones up the mountain, climbing over hurdles and tackling difficulties.

The start-up area, with a total area of 38 square kilometers, is the first construction area in xiong’an new area, which undertakes the important tasks of landing the first batch of Beijing non-capital functional relief projects, gathering high-end innovation elements and showing the embryonic form of the new district.

"Always bear in mind xiong’an new area’s initial mission as a centralized bearing place for Beijing’s non-capital functions, promote the relief projects to give priority to the new district start-up area, form scale effect and gather popularity, and build the start-up area into a high-quality model for carrying Beijing’s non-capital functions." The relevant person in charge of the National Development and Reform Commission said.

Industrial agglomeration and talent gathering are the keys to urban development.

Entering the pilot base of Science and Technology Innovation Center located in Zangang, Xiongxian County, standard factories have been built, which can meet the needs of enterprise research and development, pilot test and achievement transformation. In the workshop of Yuexiang Xiong ‘an Technology Co., Ltd., a production line has been installed, and the intelligent vehicles assembled from here will be applied to many intelligent scenes in Xiong ‘an.

The intelligent networked bus line 901 test vehicle stopped on the road in Rongdong District, xiong’an new area, Hebei Province (photo taken on March 20, 2023). Xinhua News Agency reporter Yan Yushe

"At present, the intelligent networked bus we produced has been road tested in Rongdong District, xiong’an new area, and will soon be included in the urban bus system in this area." Liu Long, factory director of Yuexiang Xiong ‘an Technology Co., Ltd., said that the enterprise will also cooperate with some well-known universities to set up an intelligent network teaching and training base in Xiong ‘an.

With the acceleration of Beijing’s non-capital function relief, a number of market-oriented relief projects have been promoted in an orderly manner, and the city’s comprehensive carrying capacity has continued to improve.

Just after the two sessions of the National People’s Congress, Qi Xiangdong, member of Chinese People’s Political Consultative Conference and chairman of Chianxin Technology Group, immediately convened management in Beijing to plan to speed up the layout of cutting-edge technologies in xiong’an new area.

This is the night view of xiong’an new area Business Service Center (photo taken on September 7, 2022, photo of drone). Xinhua News Agency reporter Zhu Xudong photo

Six years ago, Chianxin registered a wholly-owned subsidiary in xiong’an new area. At the end of 2022, the first landmark urban complex in the new district — — Xiong ‘an Business Service Center was put into use, and Chianxin became the first batch of enterprises to settle in.

Qi Xiangdong said that with the acceleration of Beijing’s non-capital function, Xiong ‘an, a new city, will produce a large number of digital new scenes and a good innovation environment. The company plans to set up a digital city security headquarters in Xiong ‘an, establish a digital city network security research institute and a network security talent training base, and actively participate in the construction of digital cities in the new district.

Cai Jiliang, director of the Investment Promotion Division of the Administrative Committee of Xiong ‘an Pilot Free Trade Zone, is a temporary cadre from Wuxi, Jiangsu Province. He recently contacted more than 100 enterprises and nearly 10 industry associations and felt the concern of the outside world about the development of Xiong ‘an. "It is not easy for the industry to gather and grow a little bit, but Xiong’ an is moving forward."

The development of industry provides soil for talent gathering.

Recently, Zhu Ninghua, academician of China Academy of Sciences and president of Xiong ‘an Innovation Research Institute of Chinese Academy of Sciences, received a "Hero Card" A card. According to the new district policy, he can enjoy 14 specific support measures, including direct settlement, transportation, medical care and health, and children’s education.

Up to now, the first batch of "Xiongcai Card" in xiong’an new area has passed the examination of 3,774 people, all of whom are urgently needed talents in the new district, among whom 38 people have obtained A cards, 588 people have obtained B cards and 3,148 people have obtained C cards.

Tang Puliang, head of the Talent Working Group of the Party-Mass Work Department of xiong’an new area, said that xiong’an new area has fully implemented the "Talent Plan", and has successively selected and recruited more than 3,000 talents from "double-class" universities, introduced 12 academicians and other high-end leading talents through various channels, introduced more than 100 talents from key areas of planning and construction, and added more than 25,000 innovative and entrepreneurial talents.

Reform, opening up and innovation are the source of xiong’an new area’s development.

Online submission of application for relocation, mutual check of electronic file information, and self-service printing of business license … … In a few days, Baoye (Beijing) Building Technology Co., Ltd. got the business license registered as Baoye (Xiong ‘an) Building Technology Co., Ltd.

"People are in Beijing, ‘ Online migration ’ Eliminate the twists and turns of submitting materials and mailing paper files back and forth. " Shi Xuejun, a staff member of Baoye (Xiong ‘an) Building Technology Co., Ltd. said.

In July last year, xiong’an new area took the lead in launching the whole process network system for inter-provincial migration of enterprises in China, and more than 20 enterprises have handled the migration business through this system.

This is Rongdong District, xiong’an new area (photo taken on March 24th, 2023). Xinhua News Agency reporter Yan Yushe

Collaborative development itself is a deep-seated reform. General Secretary of the Supreme Leader stressed that in order to give xiong’an new area autonomy in development, it is necessary to give full support to Xiong ‘an as long as it is conducive to its innovation and development.

According to "Guiding Opinions of the Central Committee of the Communist Party of China and the State Council on Supporting Comprehensive Deepening Reform and Opening-up in xiong’an new area, Hebei Province", by 2022, the role of reform and opening-up as the fundamental driving force for xiong’an new area’s development will be revealed; By 2035, the standard system of "Xiong ‘an Quality" will be basically mature and gradually popularized, which will further highlight the leading role in promoting high-quality development.

The large-scale department system and flat management have been implemented, and the innovation and development, urban governance, public services and other aspects have been tried first, and the first breakthrough has been made. At present, 19 reform supporting implementation plans have been issued by relevant parties, providing strong policy support for the development of the new district.

In the past six years, xiong’an new area, Hebei Province, has been growing at jointing stage and flourishing day by day.

On March 27th, a symposium was held in xiong’an new area. The first batch of four universities, including China Geo University (Beijing), Beijing Jiaotong University, University of Science and Technology Beijing and Beijing Forestry University, which have been relocated to xiong’an new area, will explore the establishment of a collaborative innovation alliance among the four universities to contribute to the construction of an innovation ecosystem in Xiong ‘an.

On March 29th, a symposium focusing on promoting the development of aerospace information industry and satellite Internet was held, aiming at providing important support for xiong’an new area to build an innovative highland … …

In the eyes of international public opinion, Xiong ‘an will become a platform for polishing the technology and concept of future urban construction. "This is a city focused on development and a people-oriented city."

Under the leadership of the CPC Central Committee with the Supreme Leader as the core, we will maintain historical patience, work one after another, ensure a blueprint to the end, and strive to create "Xiong ‘an quality". Chinese modernization will present more beautiful scenes here.

The advantages of Volkswagen magotan GTE choosing it

GTE is a plug-in vehicle with oil and electricity, which has the following advantages:

1. Oil and electricity: Volkswagen GTE is equipped with a gasoline engine and motor, which can switch between pure electric mode and hybrid mode as required. In pure electric mode, Volkswagen Magotan GTE can drive with zero emissions, while charging through charging piles or sockets, and the cruising range is enough to meet the needs of daily commuting and short-distance driving. In the hybrid mode, the gasoline engine and work together to provide higher cruising range and power output, which is suitable for long-distance driving.

2. Energy conservation and environmental protection: Volkswagen Magotan GTE has zero emissions in pure electric mode, which reduces environmental pollution and helps to improve air quality. At the same time, in the hybrid mode, the cooperation between the motor and the gasoline engine can maximize the fuel utilization and reduce fuel consumption and exhaust emissions.

3. Preferential policies: As a new energy vehicle, Volkswagen Magotan GTE can enjoy some preferential policies given by the government to new energy vehicles. For example, the purchase of new energy vehicles may be subsidized or exempted from vehicle purchase tax. In addition, because Volkswagen Magotan GTE does not produce exhaust emissions in pure electric mode, it can be exempted from the restrictions on fuel vehicles in some cities.

4. High performance and comfort: Volkswagen Magotan GTE has excellent performance in power, and its motor and gasoline engine work together to provide smooth and rapid power output. In addition, the interior design of this model is exquisite, the seats are comfortable, and it is equipped with rich technology and convenient functions, which provides a good driving and riding experience for drivers and passengers.

It should be noted that everyone’s car needs and preferences are different, and the budget, car size, safety performance and other factors should be comprehensively considered when choosing the right car type.

The most important point: at this stage, the GTE model only needs 180,000+,and it is absolutely worthwhile to buy it in a limited time!

Silk Road Science City "combination boxing" plus code to help!

Silk Road Science City "Combination Boxing" Plus Code

Help Xi ‘an regional science and technology innovation center construction.

Build a major national science and technology infrastructure, improve the transformation efficiency of hard science and technology innovation achievements, enhance the kinetic energy of hard science and technology innovation, and release the amplification effect of technology and finance’s mutual ride … On April 25th, at the press conference of "Building a World-leading Science and Technology Park and Helping the Construction of Xi ‘an Regional Science and Technology Innovation Center" held in Xi ‘an High-tech Zone, Xiaoxin was informed that Silk Road Science City was driven by innovation to cultivate development kinetic energy, gather science and technology resources, consolidate the industrial foundation, and play a series of "combination boxing" for regional science and technology innovation in Xi ‘an.

At present, the high-precision ground-based timing system located in Silk Road Science City is about to enter the stage of equipment debugging, and the advanced attosecond laser facility project has been officially launched. The relocation of the Institute of Earth Environment of Chinese Academy of Sciences is in progress. The State Key Laboratories of Chinese Academy of Sciences Time Benchmark and Application, Ultra-fast Light Science and Technology, and Loess Science have signed contracts to settle in Xi ‘an Science Park, which will promote the coordinated development of scientific apparatus clusters and strengthen the original innovation breakthrough ability and scientific apparatus diffraction power.

At the same time, Silk Road Science City uses advanced photonic device engineering innovation platform, Yisiwei R&D Center and other pilot platforms to cultivate technical managers and science and technology partners, strengthen cooperation between enterprises, universities and institutes, build a cooperation platform in Industry-University-Research, promote the integrated development of educational and scientific talents, build a collaborative innovation mechanism, and consolidate the foundation of new quality productivity.

In addition, Silk Road Science City focuses on strengthening the chain of leading industries such as optoelectronics, new energy vehicles, intelligent manufacturing and biomedicine, strengthening the dominant position of enterprise innovation, promoting the high-end, intelligent and green development of manufacturing industry, cultivating emerging industries such as artificial intelligence and additive manufacturing, and proactively laying out future industries such as life health and brain-like intelligence.

On the basis of the headquarters of 20 science and technology financial enterprises, Silk Road Science City has vigorously introduced new productive service formats such as digital finance and scientific and technological services, and promoted the acceleration of the economic cluster of the future headquarters. We will continue to improve the ecological service system of venture capital such as Xi ‘an Science and Technology Fund Park, innovate the service system of "science and technology+finance", and vigorously develop technology and finance and industrial fund services.

In the next step, Silk Road Science City will take the construction of a regional science and technology innovation center as the traction, implement the integration development path of science and technology industry with enterprises as the main body, demand as the guidance and platform as the support, promote industrial innovation with scientific and technological innovation, build new advantages in building a modern industrial system, and form a powerful engine to promote the high-quality development of high-tech zones.

Original title: "Silk Road Science City" combination boxing "plus code to help! 》

Read the original text

News and newspaper abstracts

Column name

News and newspaper abstracts

Date of establishment

April 10, 1950

Column cycle

Seven issues a week

Broadcast channel

Voice of China

languages

Chinese

Broadcasting unit

the China Central People’s Radio Station

creator in chief

Collective (Yan Xiaoming, Zizhong Zhao, Shi Min, Cai Xiaolin, Hou Donghe, Wang Kai, Li Wei, Gao Yan, Wang Huaqiang, Wei Manlun, Fan Yongxin, Chen Bingke, Xiao Zhitao, Chen Junjie, Chen Liang (small), White, Bai Jian, Wang Yipeng, Cui Tianqi, Man Chaoxu, Xu Jing, Yang Juntian, Feng Shuo.

Participate in the evaluation

special column

brief introduction

?????News and Newspaper Summary, a 67-year-old column, is the flagship column of china national radio, the oldest and most influential broadcast current affairs news column in China, enjoying high prestige and great appeal in the national press, with hundreds of millions of regular listeners.

?????News and Newspaper Abstract is the propaganda position of the Party and the government. It must always be the Party’s surname, adhere to the unity of party spirit and people’s nature, organize and carry out reports closely around the central work of the Party and the state, and strive to explain the principles and policies of the Party and the state to the people thoroughly and clearly, turn the Party’s theory, line, principles and policies into the conscious actions of the people, and always be the disseminator of the Party’s policy propositions.

?????《新闻和报纸摘要》宣传党和国家大政方针,报道国内外重大事件,呈现地方新鲜气象,反映社会普遍问题,在各个方面、各个环节都坚持正确的舆论导向。栏目以团结稳定鼓劲、正面宣传为主,既准确报道个别事实,又从宏观上把握和反映事件或事物的全貌。既唱主旋律,也不回避工作中存在的问题,激浊扬清,引导公共舆论走向,发挥喉舌作用,突显央广重要宣传阵地和舆论前哨的作用和价值。

?????牢记使命,不断前进。2016年《新闻和报纸摘要》围绕“创新”进行了科学的、大胆的、卓有成效的改革,让老品牌焕发了新风采。

?????一、做精“头条工程”,围绕最高领袖总书记和中央中心工作,履行中央媒体职责使命。

?????1.2016年,《新闻和报纸摘要》结合最高领袖总书记系列重要讲话精神,紧紧围绕中央中心工作,把握中央媒体定位,以“头条”为统领,以时政新闻为主线,创新主题报道,推出了以《领航!习总书记改革方略》为代表的一系列专题报道,努力刻画好以最高领袖同志为核心的党中央带领全国人民实现“中国梦”征程上的一个个伟大图景。

?????2. In 2016, Chairman Supreme Leader went abroad for five times, with a journey of 75,000 kilometers, visited 16 countries and participated in five international summits, expounding the "China Plan" for world security and global governance, and contributing "China wisdom". News and Newspapers Summary published regular columns such as President Xi’s Diplomatic Moment and Visiting with the Chairman of the Supreme Leader, which showed the confident, honest and pragmatic diplomatic style of the Chairman of the Supreme Leader as a leader of a big country in an all-round way.

?????3. actual sound, the General Secretary of the Supreme Leader, was used extensively to restore the important speech of the General Secretary truly and vividly, forming a unique auditory charm and emotional impact, enhancing the persuasiveness and appeal of the manuscript, highlighting the unique advantages of the broadcast media and amplifying the news communication effect.

?????4. 2016 is the first year of the Thirteenth Five-Year Plan, and it is also a crucial year to promote supply-side structural reform. News and Newspapers Summary has successively opened columns such as Exerting Power on the Supply Side, Creating New Kinetic Energy, Reform Research Bank, Tracking and Implementing Reform, Decoding Chinese-style Innovation, Searching for the Star of Private Enterprises, etc., connecting with the big theme from a small incision, reflecting the big mission with little people, digging deeply, and reporting continuously, with great momentum, which not only fully shows the achievements of the current supply-side reform, but also objectively reflects the supply-side structure.

?????5. Headlines of News and Newspaper Digest also focus on integrating reports and integrating various contents around a theme, so as to increase headline weight and improve manuscript quality. It is usually based on the instructions, speech spirit and activities of the party and state leaders, or the integrated reports of the same standing Committee on the same topic, or the integrated reports of different standing committees on the same topic. The former is like "The Spring Festival Footprint of the Supreme Leader’s General Secretary", and the latter is like "The General Secretary and the Prime Minister go to the local supervision array to provide structural reform". Although they are all old materials, we are looking for a new perspective and re-linking and editing them under the new background conditions, so as to explore new connotations and show new ideas.

?????Second, add "interpretation of current affairs" and use popular language to thoroughly explain the rich information contained in current affairs reports.

?????The leaders’ report of News and Newspaper Summary not only pays attention to sound recording, but also pays attention to connotation interpretation, and "translates" current political news for the people so that they can hear and understand clearly. Interpretation starts from the details to find the angle, such as "The first inspection of the central leaders in the New Year is meaningful?" ""Why did the General Secretary rush to Jinzhai for more than four hours? ""Why did China leaders repeatedly urge the United States and Europe to terminate Article 15 of the WTO as scheduled? ""What kind of talents does Schwarzman Scholars pay attention to? ",etc., with the help of authoritative think tanks, vividly use the language of the people, so that the voice of the CPC Central Committee can be heard by the masses and understood by the masses, not only as a" mouthpiece "of the party, but also as a" speaker ".

?????Third, comments return, convince people by reasoning, and shoulder the responsibility of the central media to guide public opinion.

?????News commentary is the soul and banner of the media. In 2015, CCTV launched "Central Broadcasting Review" and "Central Broadcasting Review", which assumed the responsibility of the central media to guide public opinion. In 2016, News and Newspaper Summary keenly grasped the party’s feelings and public opinions, and launched a series of comments, including Sixteen Lectures on Managing the Party and Governing the Party on the major policies of the Party and the State, Addressing social hot issues requires a multi-pronged approach, Is it true patriotism or is it a slap in the face of patriotism, and China people don’t believe in evil and are not afraid of ghosts, which must immediately clarify fallacies and distinguish between right and wrong. These comments have a high political position, clear narrative and meticulous logic to convince people. This is not only the need to unite the people and boost morale, but also a firm practice of the party spirit principle of "the party media is the party".

?????Fourth, the introduction of "two micro-ends" in "newspaper abstracts" is open and diverse, and the integration of new media has achieved initial results.

?????In 2016, News and Newspaper Digest changed the simple "newspaper digest" to "all-media scanning", changed the situation of passively relying on newspaper contributions, and expanded the content source from print media to "two micro-portals", from industry media to comprehensive media, from information gathering to viewpoint collection, which revitalized media resources, and embodied the program quality of News and Newspaper Digest, which kept pace with the times and was open and diversified.

?????Fifth, innovate the small section of "News EMU", increase the amount of information and improve the audibility.

?????Because there is little news at night, and News and Newspaper Summary is broadcast every morning, it does not have an advantage in the timeliness of some news. Therefore, the column reduces some recorded news that has been broadcast the day before, refines the essence, and packs it to create a fixed small section "News EMU". This style of news is between the finished recording and the newsletter, which is more concise than "single shot" and more vivid than the newsletter, enriching the form of news works; It appears in the form of combination, which saves the time resources of the program; It also makes the column structure more reasonable, with a clear hierarchy, improves the rhythm of the column and enhances the audibility of the column.

?????The data shows that the market performance of News and Newspaper Summary is still outstanding in 2016, and its market share and listening rate are in the forefront in the listening markets of six cities including Beijing, Shanghai, Shenzhen, Chongqing, Hefei and Urumqi.

recommend

unit

idea

?????News and Newspaper Abstract, as a famous column in china national radio, has a long history and far-reaching influence, and has a high professional level and social reputation.

?????News and Newspaper Summary always takes the party as its surname, takes the people as its center, carries forward the main theme, spreads positive energy and firmly sends out the national voice.

?????In 2016, the column respected the law of news dissemination, innovated methods and means, and strengthened the responsibility and mission of the central media through a series of revisions, achieving historical breakthroughs in listening rate, market share and social response. This column meets the requirements of famous columns and is hereby recommended.

?????

︵

Initial push

Comment and recommendation

decide between right and wrong

Language reason

︶

?????News and Newspaper Summary, as an old and famous column with a history of 67 years, has hundreds of millions of listeners all over the country. Now, the column keeps pace with the times and makes the old brand glow with new elegance, which is reflected in the following new aspects: First, the old theme is new and the headlines are more exciting. This column pays attention to both sound recording and connotation interpretation, so that the voice of the CPC Central Committee can be heard and understood by the masses, and the party spirit and people’s nature can be perfectly unified. Second, with the addition of new media, the road to integration is wide. Since 2016, this column has changed the simple "newspaper summary" to "all-media scanning", from the collection of information in the past to the collection of views now, which has revitalized media resources and won the recognition of the audience. Third, innovate small plates to improve audibility. What is the most difficult for the old brand column? There is no doubt that it is innovation, but this column has not only achieved it, but also achieved results. The new section "News EMU" concentrates, refines and packages the old news of the previous night to form a group of short, flat and fast news with sound, which improves the rhythm of the column, makes the column more concise, vivid and concise, and improves the listening effect.

China employees face an invisible ceiling at the IMF: far from reaching the proportion of votes.

He Dong, assistant managing director of the Hong Kong Monetary Authority, will be promoted to return after leaving the International Monetary Fund (IMF) for 10 years, which has encouraged China economists who used to work for the IMF, but also triggered their reflection and emotion about Chinese’s invisible ceiling in the IMF. The proportion of IMF employees is similar to that of voting rights of member countries, but the fact that China’s voting rights in the IMF are lower than the proportion of GDP in the world and other reasons, such as cultural differences, have always led to the shortage of China employees working in the IMF.

China Business News reported on September 17th that the Hong Kong Monetary Authority (HKMA) announced on September 1st that He Dong, the assistant managing director of HKMA, had tendered his resignation, which took effect on October 18th. He Dong will rejoin the IMF as the Deputy Director of the Bureau of Monetary and Capital Markets. This personnel change has aroused great repercussions among economists in China, especially those who have worked for the IMF.

He Dong, Assistant Managing Director of Hong Kong Monetary Authority, will be promoted to return after leaving IMF10.

The Bureau of Money and Capital Markets is one of the four core functional departments of the IMF. There are two ways to divide IMF departments. First, it is divided into five departments according to the region, including Europe, America, Asia-Pacific, Middle East, Central Asia and Africa; Second, according to the division of functions, it is divided into four departments: monetary and capital market bureau, financial affairs, research and strategic development.

Return to IMF

He Dong is the first Chinese to return to the IMF from Hongkong. He holds a Ph.D. in Economics from Cambridge University. He is responsible for the research on monetary and financial stability in the HKMA and is also the director of the Hong Kong Financial Research Center.

Chen Delin, President of the Hong Kong Monetary Authority, expressed "deep regret" for He Dong’s departure. He said that since he left the IMF to join the HKMA in 2004, He Dong has made great contributions to enhancing the research capabilities of the HKMA and the Hong Kong Financial Research Center.

A China economist who works in an overseas investment bank said,The Hong Kong Monetary Authority is equivalent to the central bank level. As the research director, He Dong has always been in the regulatory body, which is consistent with the perspective of the IMF.I am excited that he can serve as the deputy director of the Monetary and Capital Markets Bureau.

He Dong joined the Hong Kong Monetary Authority after leaving the IMF in 2004.

He Dong worked in the World Bank and the IMF. Before joining the Hong Kong Monetary Authority in August 2004, he was a senior economist at the IMF..

He Dong is a low-key and steady person with a wide range of research topics, especially publishing many research articles on the macro-economy and financial markets in Hong Kong and the Mainland.

Many economists said that,He Dong has a deep research on the internationalization of RMB. On behalf of the Hong Kong Monetary Authority, he has been communicating with the People’s Bank of China on RMB internationalization and offshore RMB market in Hong Kong..

From professional staff to management level, jump four levels in ten years.

"He Dong has been promoted to Grade 4 in the past ten years. It is absolutely impossible for him to stay in the IMF." A former IMF economist in China said.

Before joining the Hong Kong Monetary Authority, He Dong had been an A14 economist at the IMF. This time, his level rose directly to B04, a senior management level.

According to the above economists, the IMF is divided into A01~A15 and B01~B05, where A is the employee level and B is the management level, and A15 to B01 is a hurdle in the position.

According to him, He Dong had the idea of returning to the IMF a few years ago. At that time, the IMF only wanted him to return at A14 level. This time, he was able to go back to B04 at once, which was "surprising".

According to the information of IMF’s human resources department, A01~A08 are logistics support employees, A09~A15 are economists and other professional employees, and B01~B04 are management-level employees.

B05 already belongs to the level of senior officials, such as Lin Jianhai, who became the Secretary-General of the IMF two years ago. Zhu Min, the vice president of IMF, is an executive director, which is an MD level outside the employee level..

An IMF spokesperson said that He Dong was appointed because of his experience and professionalism in the Hong Kong Monetary Authority.

Chinese faces an invisible ceiling at the IMF.

The above-mentioned economist who once worked in the IMF said, "The IMF has an invisible ceiling, and Chinese does not have its own circle in these institutions, nor can it enter other people’s small circles"; "Until now, I can’t tell the difference between baseball and American football. How can I communicate with other European and American colleagues?"

Compared with cultural differences, the lack of government-led promotion is a more important reason.According to informed sources, Japan, South Korea and other countries have similar cultures to China, but the Japanese government has an agreement with the IMF, and both the Japanese Ministry of Finance and the Bank of Japan will send management-level officials to the IMF. In China, however, there is no such arrangement, and exchanges remain at the middle and lower levels, and senior officials of the central bank are reluctant to go to the IMF.

The proportion of IMF employees should be close to the proportion of national voting rights, and China employees are far from reaching the proportion of voting.The person said. There are some junior China economists in the economist training program, but only a handful of Chinese can enter the management. He counted three people with his fingers broken, and He Dong was the fourth.

IMF China is understaffed.

The IMF was established in July 1944 with the aim of promoting international financial stability and monetary cooperation, promoting the development of international trade, high-level employment and sustainable economic growth, and reducing world poverty. Its scope of economic supervision has expanded from the initial balance of payments to the monetary, fiscal and monetary policies of member countries.

China’s voting rights in international regulatory bodies such as the IMF have been quite low.Emerging economies are playing an increasingly important role in global economic affairs, and their voting rights should be adjusted accordingly. Although China’s voting rights have been improved to some extent in the IMF and the World Bank, they still failed to meet expectations.

According to IMF official website, after the reform in 2010, China’s voting right rose from the previous 3.803% to 6.068%.

Zhu Min, vice president of IMF, said at an event recently,According to the IMF’s articles of association, the IMF is headquartered in the country with the largest shareholder, and the United States currently accounts for 15%.However, with the increasing economic aggregate of China, the IMF headquarters will move to China one day.

However, the lack of employees in China has kept this idea at the stage of shouting slogans.

IMF China is understaffed.

IMF jobs are not well paid but attractive.

He Dong’s return to the IMF this time is actually a salary reduction return. A former IMF economist said,The annual salary of the assistant managing director of the HKMA ranges from HK$ 4 million to HK$ 5 million (equivalent to RMB 3.17 million to RMB 3.97 million), while that of the B04 level of the IMF ranges from US$ 200,000 to US$ 300,000 (equivalent to RMB 1.23 million to RMB 1.84 million)..

The former IMF economist said that in fact, many China economists who came out of the IMF wanted to go back to the IMF.As an official institution, the IMF’s salary is not higher than that of foreign investment banks, but it is particularly attractive..

The IMF is a public institution where elites gather. As an economist, the perspective is from the official perspective of policy makers. This will greatly improve the research depth and quality of life for international investment bank economists who are exhausted and cope with market changes and customer requirements.

"Investment bank economists put it mildly, just like salesmen." The reporter of China Business News quoted a big bank economist as saying, "Occasionally, we will meet very difficult customers, but at the IMF, we are all faced with officials at the level of finance ministers."

In addition, China economists in the market are now in a state of oversupply, and the income and attractiveness of the private sector are not as good as before.

And the IMF also has generous benefits. A former IMF economist said,IMF income does not need to be taxed, and it provides a fixed retirement pension. Children’s education also has an annual allowance of 50,000 to 60,000 US dollars..

Such a carefree life, why did these China economists choose to leave in the first place? The above-mentioned people said that the IMF also has the problem of overstaffing.The IMF encourages employees to go to the private sector by leaving their jobs without pay, but if they want to go back to the IMF, they can basically only be rehired..

Many outstanding former IMF economists have chosen to transform themselves after reaching a certain level in international investment banks. Some have become strategists for private big customers, such as Ha Jiming; Some set up hedge funds on their own, such as Wang Qing; There are also more successful central banks, such as Ma Jun. This may be a loss for China, which wants to enhance its voice in international institutions.

Strengthening the Party’s Armed Forces of Innovation Theory (People’s Forum)

In 1938, a 17-year-old young woman walked more than 1,000 kilometers from Beijing to northern Shaanxi with 5 yuan. Her heart was deeply touched: "In the summer evening, the horse galloped briskly, and I felt all this was so novel and mysterious!" " Shine the light of truth and forge lofty beliefs, so that Yan ‘an led by the Communist Party of China (CPC) is like a huge magnetic field.

Today, one of the data in the white paper "China Youth in the New Era" is impressive: "Since The 18th National Congress of the Communist Party of China, party member, who is 35 years old and under, has accounted for more than 80% of the newly developed party member every year." Facts have proved that our party has always been full of vigor and vitality and has become more and more attractive to young people.

Why does a century-old party remain youthful and energetic forever? A revolutionary who holds the truth is always young. General Secretary of the Supreme Leader pointed out in the party’s Report to the 20th CPC National Congress: "It is the fundamental task of the party’s ideological construction to arm the whole party with the party’s innovative theory." Recently, at the work conference on studying and implementing the theme education of Socialism with Chinese characteristics Thought in the new era of the Supreme Leader, the General Secretary of the Supreme Leader emphasized that "we should take this theme education as an opportunity to strengthen the Party’s innovative theory, constantly improve the Marxist level of the whole Party, and constantly improve the Party’s ruling ability and leadership level".

The fire of truth ignites lofty ideals. Li Dazhao once said: "The highest ideal in life lies in seeking truth." The revolutionary ideal is higher than the sky. When he was in prison, Xia Minghan, 28, was unyielding and wrote a letter to his wife: "Insist on the revolution and follow my ambition, and swear to spread the truth to others!" Because of longing for the truth, pursuing the truth and defending the truth, revolutionary pioneers and people with lofty ideals "although thousands of people have gone" and "although they died nine times, they still have no regrets."

真理之光,照亮奋进征程。犹记庆祝中国共产党成立100周年大会上,共青团员和少先队员代表集体致献词:“古老的中华大地诞生了中国共产党,播撒信仰的火种,点亮真理的强光”。从石库门到天安门,从兴业路到复兴路,中国共产党人始终坚持真理、坚守理想,把握历史主动、锚定奋斗目标,沿着正确方向坚定前行。一以贯之地坚持真理、修正错误,崇仰理想、坚定信念,是这个百年大党的魅力所在。

大道如砥,行者无疆。实践告诉我们,中国共产党为什么能,中国特色社会主义为什么好,归根到底是马克思主义行,是中国化时代化的马克思主义行。马克思主义是科学真理,如燧石一般,受到的敲打越厉害,发射出的光辉就越灿烂。回首过往的奋斗路,无论是处于顺境还是逆境,我们党从未动摇对马克思主义的信仰。坚持用马克思主义中国化时代化最新成果武装全党、指导实践、推动工作,是我们党创造历史、成就辉煌的一条重要经验。

Adhering to the guidance and arming with scientific theory is the fundamental guarantee for Marxist political parties to keep their advanced nature and purity forever, and it is also the political advantage of our party. In the new era, the complexity of the situation, the severity of the struggle, and the arduous task of reform, development and stability faced by the Party and the country are rare in the world and history. It is precisely because of the establishment of the core position of the Party Central Committee and the Party as the supreme leader and the guiding position of Socialism with Chinese characteristics Thought in the new era that the Party has effectively solved the outstanding contradictions and problems that have affected the Party’s long-term governance, the country’s long-term stability and the people’s happiness and well-being, and fundamentally ensured that the great rejuvenation of the Chinese nation has entered an irreversible historical process. Studying and implementing the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era is the fundamental requirement for the new era and new journey to create a new situation in career development. On the way forward, we must adhere to the integration of learning, thinking and application, and the unity of knowing, believing and doing, and turn the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era into a powerful force to strengthen ideals, temper party spirit, guide practice and promote work.

The wind is strong and the spring tide is strong. Passing through yesterday’s "majestic road is like iron", forging ahead in today’s "the right path on earth is vicissitudes" and looking forward to tomorrow’s "I will mount a long wind some day and break the heavy waves", the grand goal of building a strong country and rejuvenating the nation is inspiring and inspiring, and our generation of communist party people have a glorious mission and great responsibility. On the new journey, we will strengthen our political consciousness, ideological consciousness and action consciousness, learn and understand Socialism with Chinese characteristics Thought as the supreme leader in the new era, adhere to and make good use of the stand, viewpoint and method that runs through it, and implement this thought in all aspects of the work of the party and the state, and we will certainly be able to write a new chapter of the times and create new historical achievements.

Interpretation of "New Infrastructure" from the Perspective of Experts and How Blockchain Empowers Digital Economy

People’s Daily Online, Beijing, May 29 (Reporter Qiao Xuefeng, intern Jin Yusi) During the two sessions, People’s Daily launched a special program "Cloud Living Room of the two sessions", inviting NPC deputies and CPPCC members to meet with netizens on the "Cloud" to discuss hot topics.

How can new infrastructure help the modernization of government governance capacity and the high-quality development of digital economy? How does the blockchain empower new infrastructure? On May 28th, the "New Infrastructure Moment" was held in the cloud living room of the NPC and CPPCC, inviting delegates, local government leaders, experts and scholars, and representatives of outstanding enterprises in new infrastructure to talk about new infrastructure.

"We have moved from the traditional economy to the digital economy, and the digital economy will move from the lives of our people to the entire social and industrial field." Wang Xiaochuan, member of Chinese People’s Political Consultative Conference and CEO of sogou Company, said that with the development of artificial intelligence technology, machines have begun to have more technologies to imitate people’s expressions, looks or voices, and this technology can already replace the anchors of some programs. This aspect will also arouse public concern, and it is suggested that the illegal use of these technologies can be guided or restricted by legislation, which can make the industry develop better.

Wang Xiaochuan pointed out that artificial intelligence must form industrial synergy and application scenarios. The developed Internet industry in China has laid a good foundation for the development of artificial intelligence, but the core technology of artificial intelligence chips is still in western countries. We need to develop this technology to make artificial intelligence achieve comprehensive and stable development.

In view of the problem that blockchain technology helps the government’s digital governance, Feng Kui, deputy director of the Central Economic Committee of the NLD and a researcher at the Research Center for the Reform and Development of Cities and Small Towns in China, took the development plan of the Yangtze River Economic Belt and the Chengdu-Chongqing Twin-city Economic Circle as examples, and pointed out that blockchain technology can play five major roles in solving the problems of diversification and data decentralization in new spaces: "First, promote the formation of interest communities in new spaces through consensus mechanism. The second is to create transparent and trustworthy application scenarios through smart contracts. The third is to build a joint and collaborative decision-making mechanism through data sharing. The fourth is to improve the efficiency of government business by optimizing the government service process. The fifth is to improve the efficiency of market-oriented allocation by promoting the flow of factors. "

In addition, the application of digital governance in the "new infrastructure" era during the COVID-19 epidemic also showed its advantages of convenience and efficiency. Dong Xuegeng, director of the Big Data Administration of Hainan Province, said that up to now, the coverage rate of Health One Code in Hainan Province has reached 124%. The construction of epidemic prevention and control big data system not only makes the health code cover all the people in the province, but also ensures that migrant workers and tourists can also receive the code, which helps Hainan Province to achieve the two requirements of external input and internal non-proliferation.

The advantages of "new infrastructure" are obvious to all, and the development status of blockchain technology and new infrastructure, He Yifan, general manager of Beijing Jujube Technology Co., Ltd. made an answer in the program. He said: "Blockchain technology is a very new technology. At present, our country is basically on the same starting line as other countries, and the positioning of the blockchain service network is global. It is a global new infrastructure that can serve the world and developers all over the world."

Wang Zhen, general manager of Digital City Company of China Xiong ‘an Group, said that the characteristics of blockchain’s safety, credibility, openness and cooperation contributed to its integration with the "new infrastructure" of digitalization, internetization and Internet of Things.

Wang Zhen pointed out that blockchain technology can make ‘ New infrastructure ’ The data flow in the data center is moving, so that more people can participate in urban computing. At the same time, the digital currency gene of blockchain technology enables it to promote the development of "new infrastructure" in terms of operation management, financing and derivative finance by means of asset digitization.

Talking about the international competitiveness of China’s "new infrastructure" technology, Ma Jun, co-founder and partner of Tongdun Technology, pointed out that all the fields involved in the new infrastructure are high-tech frontier technologies, and the autonomy and controllability of China’s core technology must be maintained, and will become a necessary measure for the country’s high-quality development in the future.

At the same time, Ma Jun Drive suggested: "The future construction of new infrastructure is not only to build hard infrastructure, but also to build soft infrastructure. Only by combining soft and hard and inserting the wings of intelligent software into the hardware can the new infrastructure play a better role."

He Yifan, Ma Jun Drive and other representatives of new infrastructure enterprises summed up the international competitiveness and progress direction of China’s new infrastructure through the experience accumulated in the stage of technological exploration. Zhu Keli, Executive Dean of National Research Institute of New Economy, once again analyzed the relationship and prospect between "new infrastructure" and "new economy" from the perspective of long-term economic impact.

"New consumption and new infrastructure are two issues that have attracted much attention at present, and they shoulder the heavy responsibility of reviving China’s economy in the post-epidemic context." Zhu Keli said that a digital bridge between new infrastructure and new consumption is being formed historically, and the new economic logic of industrial interconnection and the digital platform make it possible for new infrastructure and new consumption to resonate at the same frequency.

Zhu Keli pointed out that the relationship between the new economy and the new infrastructure is that the new infrastructure provides an effective operating basis for the development of the new economy. As a large system, the new economy can also provide good technical support, long-term operating mechanism and broad development soil for new infrastructure.

Speaking of new infrastructure and digital economy, Geng Zhijun, vice president of Tencent, also pointed out that code economy is a new way of connection, which can gradually transfer the business model in the traditional economic society to the online. During the whole epidemic period, the relationship generated by code will become more and more obvious and more and more. "Of course, the code economy does not necessarily refer to an economy that simply links through QR codes. We are more talking about a mapping between the real world and the virtual world, or a connection between the real world and the virtual world, resulting in more economic development."

Yan Zhijun also said that it is not difficult to see from this epidemic that online and offline integration will enhance the resilience of more market players, thus boosting the digital transformation of small and medium-sized enterprises. In other words, good use of coupons can cultivate future customers of new consumption and new infrastructure, and the two will organically connect the enterprise and the government through digitalization.

Heavy surprise! "Men in Black: Global Pursuit" is the creator of Dragon Boat Festival in China.

1905 movie network news Hollywood sci-fi action giant jointly produced by Columbia Pictures and Tencent Pictures released China Special Action — — The film’s main creator is coming to China on the Dragon Boat Festival, and the lineup is unprecedented and luxurious. The two leading actors, Chris Hemsworth and tessa thompson, and the director F Gary Gray, are the first to combine into a film publicity platform.

A few days ago, the film officially launched global publicity, and the first red carpet fan activity held in Bali was even more climax, which made domestic fans envious.

Fairy group is about to airborne Beijing elite agents to start China special operation

"Men in Black: The Global Pursuit" has been highly anticipated by fans since its inception. As the hottest powerful actors in Hollywood today, "Brother Hammer" Chris Hemsworth and "Valkyria" tessa thompson have a high popularity in China, and a large number of fans are eager for idols to come to China. The two collaborated again after several Marvel Universe super-British blockbusters, and H&M, an elite agent, showed remarkable tacit understanding in the new series of Men in Black. This is the first time that the golden partner of the "God of Heaven" and Super 8 director F Gary Gray have joined forces during the film promotion period to jointly "perform special tasks" in China. Brother Hammer, Chris shared the news of his visit to China with China fans in the form of a video letter for the first time, and warmly looked forward to spending the Dragon Boat Festival with you. It is reported that tessa thompson, the heroine of the film, and F Gary Gray, the director, both came to China for the first time to promote the film works. This heavyweight lineup gathered in Beijing to reveal the wonderful stories behind the scenes of the film to the audience.

Shooting interesting things, endless high-energy warning of aliens

In the new preview released at the same time as the news of coming to China, it shows that the film incorporates a lot of sci-fi actions and humorous elements. The thrilling action scenes and the high-energy weapons of future technology make people’s hearts beat faster and ignite. In particular, the super sports car with "one button to heaven" surprise operation hides a lot of heavy firepower equipment, which is worthy of being the exclusive car of top agents! Meng Xing Bing Bing also stole the show again. In the trailer, it was trapped in a glass bottle, but it used a secret weapon to draw a humanoid door frame in the bottle. Even Agent H and Agent M were dumbfounded by the unusual move.

Earlier, Chris Hemsworth revealed in an interview, "I am very happy to participate in the filming of" Men in Black: Global Pursuit ".There are many action scenes in it that test people very much, and it is also very interesting to shoot around the world with the crew." In the movie, agent H&M will travel around the world to hunt down evil aliens, and high-energy clips emerge one after another, which is worth looking forward to. On June 14th, the most exciting sci-fi action masterpiece in the summer file will be released soon.

The film Men in Black: The Global Pursuit is produced by Steven Allan Spielberg (,), directed by F Gary Gray (,), and co-starred by Chris Hemsworth (,), tessa thompson (,), liam neeson (series,), emma thompson (,Love Actually) and Rebecca Ferguson (,).

Don’t be careless, these symptoms may be cancer signals.

In the face of cancer, everyone often talks about cancer discoloration.

The source of this fear is not groundless. In recent 40 years, the cancer burden in China has also increased significantly.

According to an article published in The Lancet Oncology by He Jie, an academician of China Academy of Sciences, in the past 40 years, the proportion of people in China who died of cancer has decreased from 1973— The proportion of cancer increased from 10.1% in 1975 to 24.2% in 2015, and the burden of cancer increased day by day.

Why are some cancers found late?

Some cancers are terminal as soon as they are discovered. Why?

First, the concealment of cancer itself is high. The incubation period of most cancers is long, which is very long, whether it is from oncogene mutation or from persistent infection with carcinogenic virus to the final formation of cancer. In this process, there may be no obvious clinical symptoms, which are not easy for patients to detect. Once there are perceptible clinical symptoms, they often metastasize, which is the advanced stage of cancer.

Second, patients are too negligent. Some cancers have nonspecific symptoms in the early stage, such as fatigue, cough, slight chest pain or abdominal pain, but many patients often neglect diagnosis and treatment, or the abnormal indicators of physical examination do not further clarify the cause, which delays the treatment opportunity.

Third, there is no regular physical examination. Many people feel healthy and refuse to have regular health checkups, but they don’t know that health checkups can find some cancers in time.

So which cancers are advanced as soon as they are discovered?

Pancreatic cancer is often called the king of cancer, and its survival rate is low. Most of the early pancreatic cancer has no clinical symptoms, and it is in the middle and late stage when it is diagnosed, so it is difficult to cure.

The incidence and mortality of lung cancer have increased the fastest, and it is one of the most threatening malignant tumors to people’s health and life. The symptoms of early lung cancer are often mild, and there may even be no discomfort.

The symptoms of early liver cancer generally have no obvious characteristics, and the middle and late stages will be accompanied by symptoms such as liver pain, abdominal distension, fatigue and emaciation.

These symptoms require vigilance.

British scholars published an article in The Lancet Oncology. By studying the data of 8,000 patients suffering from 12 common cancers, it was found that 13 of the 20 symptoms appeared in the early stage of cancer, including abnormal nevus, breast mass, postmenopausal bleeding, rectal bleeding, lower urinary tract symptoms, hematuria, change of defecation habits, hoarseness, fatigue, abdominal pain, lower abdominal pain, weight loss and so on. Therefore, once the above symptoms appear, ordinary people should see a doctor in time.

It needs to be emphasized that we should pay special attention to weight loss. A study published by Oxford University in the British Medical Journal on August 13th, 2020 shows that subjects who suddenly lose weight are twice as likely to develop cancer as those who don’t.

How do ordinary people avoid getting sick

Doing the following will help us stay away from cancer.

In daily life, people need to pay attention to stay away from ionization and ultraviolet radiation.

Develop a reasonable dietary structure and balanced nutrition. Control the intake of red meat food, choose rough grains, and increase the intake of fresh fruits and vegetables and low-calorie foods.

Keep moving properly. Adults should try to reduce sedentary time, and exercise time is recommended to be about 150 minutes per week.

Develop good habits of work and rest. Guaranteed daily 7-mdash; 9 hours of sleep, it is recommended to sleep from 10 pm to 6 am the next day.

Pay attention to controlling drinking and quitting smoking, and keep a good attitude. Learn to deal with things positively and peacefully in life, and don’t be overly anxious about everything.

Regular physical examination, arrange targeted cancer screening every year to achieve early detection and early treatment. (Source: Popular Science China)