Since the beginning of this year, urban renewal has become the key direction of the real estate market, and its importance has been further enhanced. For housing enterprises, it also indicates more opportunities.

Bring positive power

Recently, Shenzhen Trading Group issued a transaction announcement, and the land preparation interest coordination project of Sanlian Community in Jihua Street, Longgang District was won by Shenzhen Lingrui Industrial Development Co., Ltd. According to public information, the major shareholder behind the company is Futian Xingye Investment Group from Hunan.

In April 2025, Longgang District Urban Renewal and Land Preparation Bureau announced the contents of the implementation plan of the above projects, and adopted the method of "monetary compensation+retained land" to implement land preparation, with a total land preparation fund of about 572 million yuan; There are 3 cases of retained land with a total land area of about 6.22 hectares.

Progress has also been made in the reconstruction project of Buji Nanmendun Village in Longgang District, Shenzhen. According to public information, this project is currently an urban renewal project of Nanmendun. It was first included in the old renovation plan in 2008, and was approved by the special planning in 2017. In 2020, the unit planning was revised, and the updating direction was residential and commercial functions. However, in 2021, due to the break of the capital chain of the development enterprise, the project suddenly stopped working. Shenzhen Public Resource Trading Center previously announced the bid-winning result of the project’s willingness to collect services, and Shenzhen Tianjian Urban Development Co., Ltd. won the bid with 9.75 million yuan. According to some insiders, according to the past practical experience, the enterprises that have won the previous service projects have a good chance to become the follow-up development and construction enterprises of the project by mastering the first-hand information such as the market evaluation and transformation of the project and knowing the root of the project.

When the reporter visited Luohu and Longgang District in Shenzhen, he found that some urban renewal projects were stagnant. Local residents regretted the stagnation of the projects and expected the government to promote the progress, especially the original owners to participate more. According to the latest data of the city in one, as of August 3, 2025, Shenzhen has included 1061 projects in the urban renewal plan, and 750 projects have been approved by the special regulations for urban renewal, with a passing rate of 70.7%; 554 subjects were publicized, with an implementation rate of 52.2%.

Some analysts said that if the Sanlian community land preparation benefit planning project can be smoothly promoted, it will significantly enhance the city image and residential value of the whole Buji area and even the central part of Shenzhen. In addition, the entry of foreign housing enterprises into the urban renewal market in Shenzhen will also help bring positive power to the current market.

Attract social capital to intervene.

It can be seen that promoting urban renewal is an important starting point for urban work at present and in the future. Since the beginning of this year, the promotion of urban renewal has continued to increase. The the Political Bureau of the Communist Party of China (CPC) Central Committee Conference held on July 30th emphasized that the spirit of the Central Urban Work Conference should be well implemented and urban renewal should be carried out with high quality.

Li Yujia, chief researcher of the Housing Policy Research Center of Guangdong Urban Planning Institute, said that under the background of housing returning to bulk consumer goods and general consumer goods, with the major changes in the relationship between supply and demand, the past development model is unsustainable. In the new era, urban renewal, as a new driving force for growth, should promote the continuous upgrading of housing consumption through stock renewal and quality improvement, and at the same time, it can also make real estate a carrier for new citizens to take root in cities, new industries and new economy cultivation, thus giving full play to the positive role of real estate in domestic demand.

Chen Wenjing, director of policy research at the Central Finger Research Institute, said that urban renewal has become the focus of promoting high-quality urban development and the focus of real estate. In the future, various supporting policies are expected to accelerate and give full play to the role of urban renewal in stabilizing investment and expanding domestic demand. In the follow-up, the land use policy and financial policy related to urban renewal will also be accelerated, the top-level design will be further strengthened, local governments will be supported to better explore suitable and sustainable urban renewal models, social capital will be attracted, and more opportunities will be provided for enterprises to participate in urban renewal.

In addition, the Institute believes that with the changes in the macro-economy and the real estate market in the future, there is still room for improvement in various policies. At present, it is still the core goal of real estate policy to promote the market to stop falling and stabilize. In the short term, it is expected to continue to focus on the effective implementation of policies such as the transformation of urban villages and the collection and storage of special bonds. At the same time, urban renewal has become the key content to promote the high-quality development of the city, and it is also the focus of the real estate field. In the future, various supporting policies are expected to accelerate.

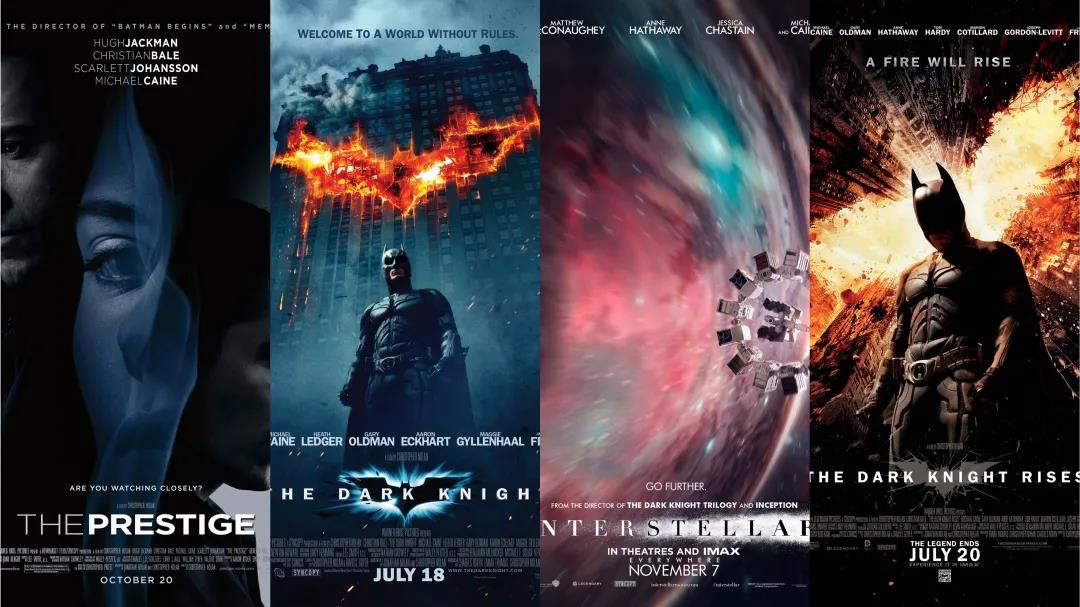

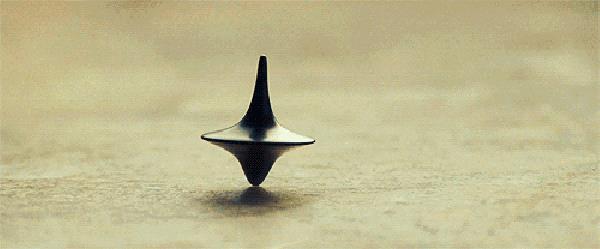

Memento movie stills

Memento movie stills

Memento movie stills

Memento movie stills